Trade wars can have widespread negative impacts on the global economy, weighing down on global growth and investment, while increasing uncertainty and market volatility. How will Malaysia and her regional peers fare in the ongoing US-China trade conflict?

Far from being a month of quiet introspection, December 2019 has instead proven to be a maelstrom of activity for trade policy enthusiasts. On December 10, the World Trading Organisation (WTO) dispute settlement mechanism virtually ceased functioning as the United States (US) continued to block the appointment of new judges to its appellate body. On December 12, after months of negotiations, the US and China reached a “Phase One” deal – in which China agreed to certain concessions on agricultural purchases and intellectual property in return for some tariff cuts from the US.

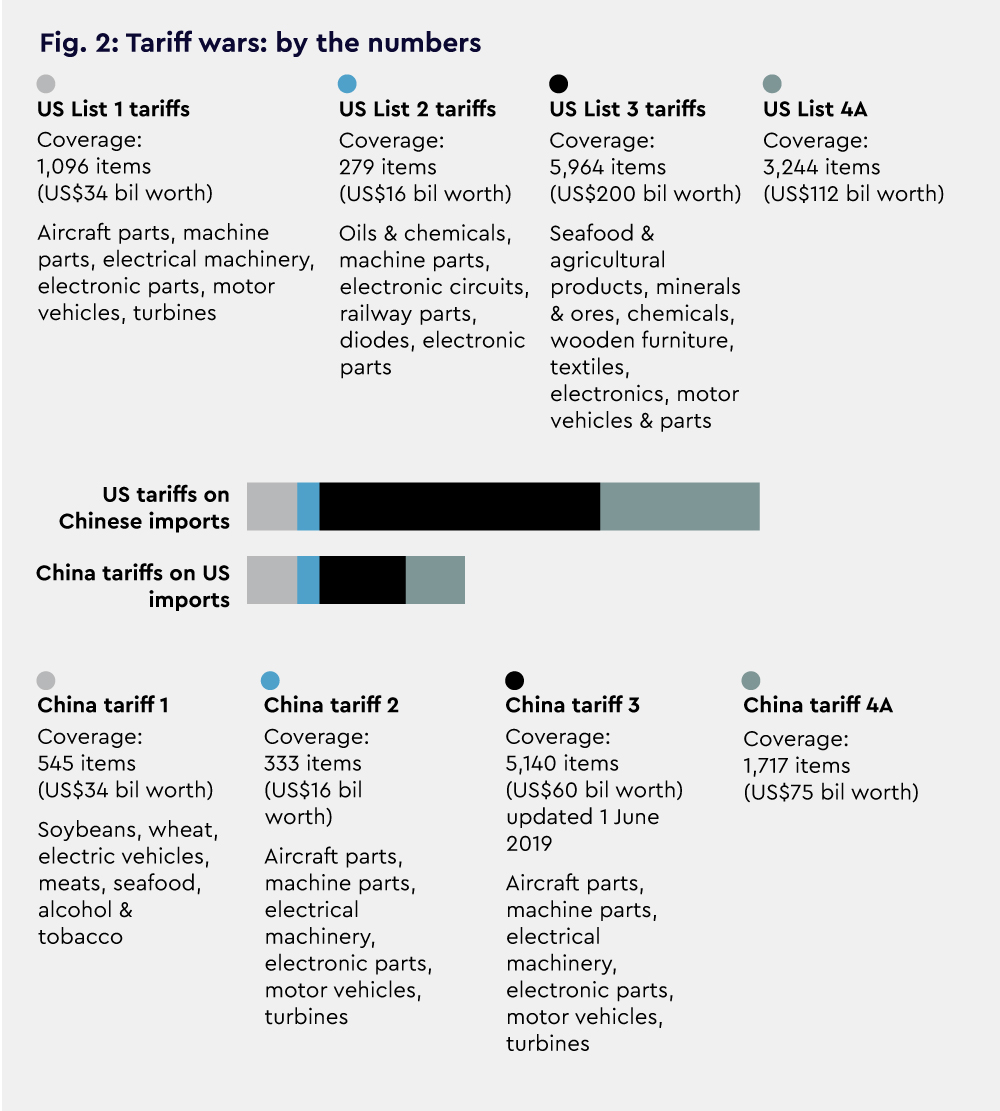

The last two years have been equally as tumultuous. Since the start of 2018, the US has fought a multi-front trade war, imposing Section 301 tariffs on approximately US$370 billion worth of Chinese goods entering the US. Over 10,583 different Chinese products across three separate US tariff lists (List 1, List 2 and List 3) are currently subject to what is essentially an import tax. Even with the tariff reductions from the “Phase One” agreement, average US tariff levels are still more than six times higher than before the trade war began.

By now, even Mr Trump’s most steadfast tariff stalwarts would need to admit that the US-China trade war are having negative impacts on the world economy. As trade uncertainty continues to curtail business investment and dampen world trade, the world economy is chugging along at the slowest pace since the 2008 financial crisis. In the US, recent research suggests that US consumers are paying for the tariffs imposed on Chinese goods in the form of higher prices. Indeed, one estimate of the welfare loss to the US consumer and firms who buy imports is about US$51 billion per year.

Yet for Malaysia and other exporting economies in the region, the impacts of the US-China trade conflict may be slightly more ambiguous. Here, it is important to note that these trade tariffs bring about two competing, opposing effects.

The first is a negative effect from a general reduction in world trade and increased global uncertainty. Many economies in the region, like Malaysia, are small and highly open economies with a relatively high dependence on trade. Many are also deeply integrated with global and regional supply chains. In Malaysia, over 82 percent of large firms in Malaysia and nearly 50 percent of all small-to-medium-sized enterprises participate in global value chains. This means that negative shocks to world trading demand and disruptions to global supply chains can have outsize effects on economic activity. Recent macroeconomic data in Malaysia suggests that global headwinds are increasingly depressing domestic economic activity.

The second effect is the silver lining: the potential for beneficial trade and investment diversions. As the imposition of tariffs cause importers to look elsewhere for substitutes, exporters in the region stand to benefit. In fact, one estimate of the total value of global trade that will be diverted per year to avoid tariff incidence is about US$165 billion. Additionally, the first two rounds of US tariffs heavily concentrate on electrical and electronic (E&E) components and circuits – products that Malaysia has comparative advantages in exporting.

As such, the net impact of the trade war on the region will depend on which one of these two opposing effects win out.

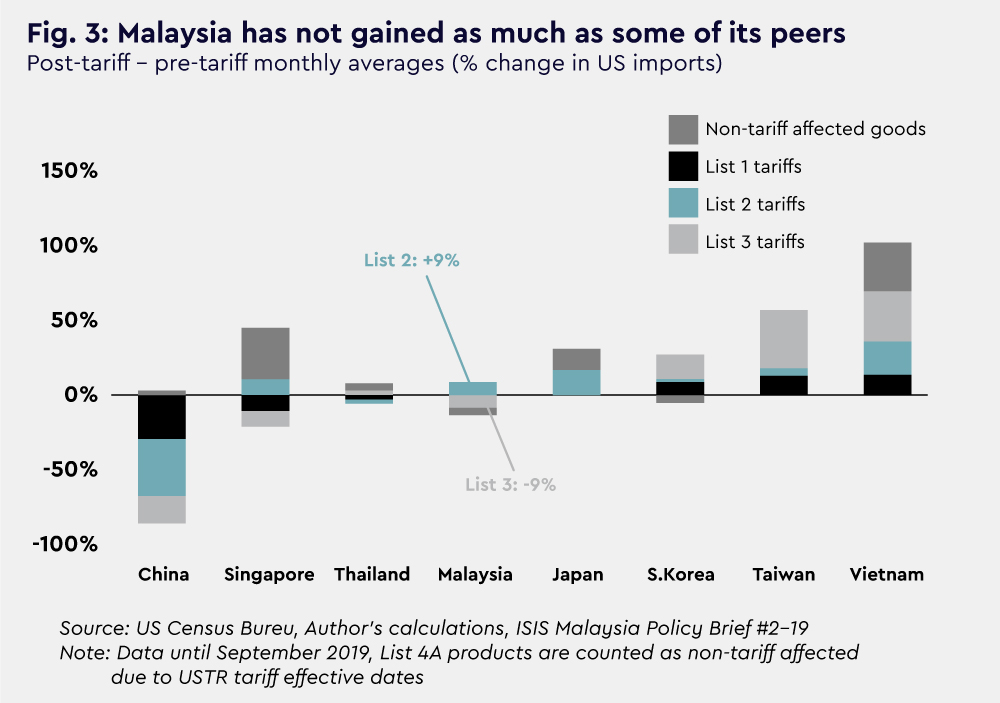

Broadly, there are two main channels for trade diversion: shifts in US import demand and shifts in Chinese import demand. To gauge shifts in import demand from the US side, we built on some recent analysis using detailed US Census trade data – matching US imports of goods at the HS 8-digit level to the approximately 7,452 products on the first three tariff lists released by the US Trade Representative’s (USTR) office. Comparing post-tariff versus pre-tariff averages of US imports from eight regional economies, we were able to examine the economies and products that have enjoyed trade gains from diversion in US import demand.

Our estimates suggest that Vietnam and Taiwan have been the largest beneficiaries of diversions in US import demand after the imposition of tariffs (Fig. 3). Likewise, Malaysia has indeed seen some gains in US imports of List 2 products – which mainly consist of E&E components. However, these trade gains have not been as large as other economies in the region, with US imports of List 3 products from Malaysia actually declining in the post-tariff period.

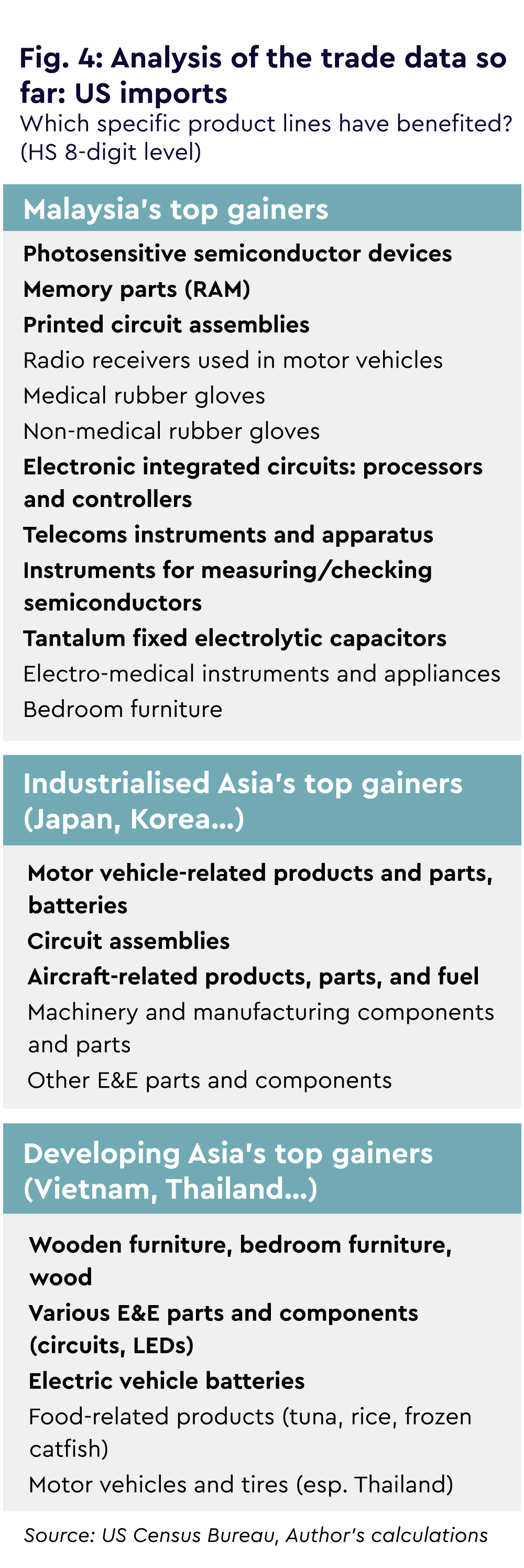

Looking deeper into each individual product at the HS 8-digit level, our analysis suggests that Malaysia has mainly gained in US imports of E&E-related product – specifically semiconductor devices, electronic integrated circuits and telecommunications equipment – in addition to other non-E&E products, like rubber-related goods and wooden furniture (Fig. 4). Grouping the rest of the seven regional economies in two groups – industrialised and developing – broad trends emerge: industrialised Asian economies have seen large gains in motor vehicle and aircraft-related exports to the US, in addition to E&E components – while developing Asian economies, like Thailand and Vietnam, have gained in lower-value products, like wood products, some machinery components and foodstuff (Fig. 4).

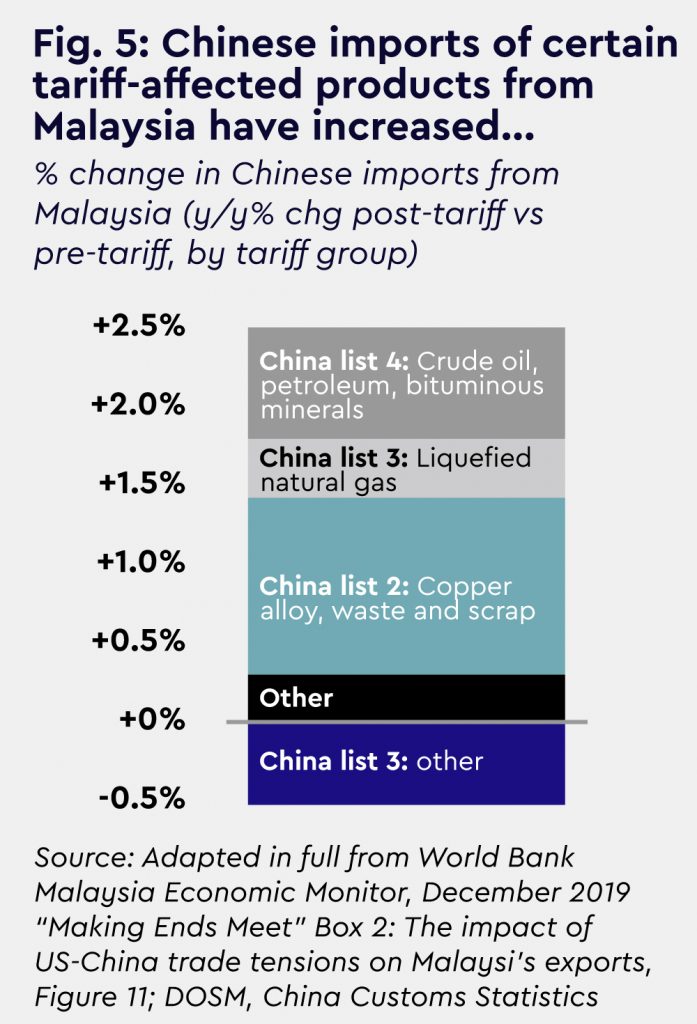

Moving to trade diversions arising from shifts in Chinese import demand, a World Bank report released in December 2019 suggests that Chinese imports of certain tariff-affected products from Malaysia have indeed increased. Interestingly, we can see that these products are vastly different from the types of products that have gained in terms of shifts in US imports (Fig. 5), with the report highlighting that Malaysian products that have gained are mainly concentrated in energy-related commodities, like liquefied natural gas (LNG) and crude oil derivatives, along with other commodities like copper-related products.

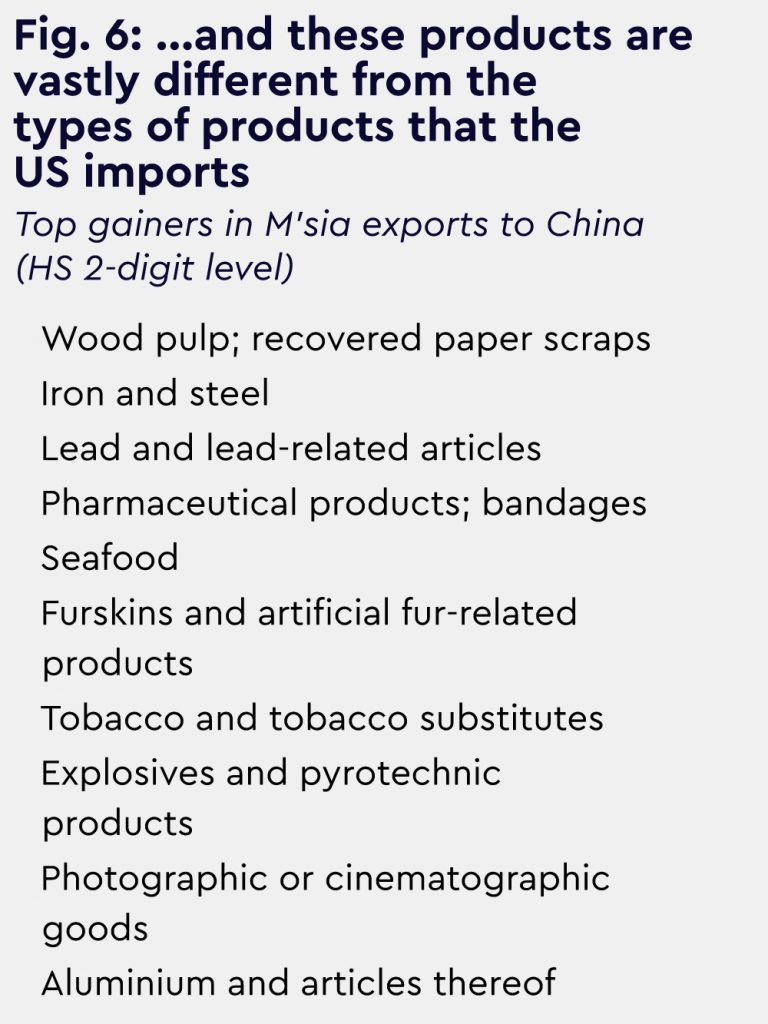

Our own estimates support this: using Malaysian export data at the HS 2-digit level and comparing pre-and-post tariff performance, we estimate that top gainers in terms of Chinese import demand shifts are wood pulp and paper scraps (used to make recycled paper), metal-related products (iron, steel and lead) and other miscellaneous products from medical bandages to seafood to furskins (Fig. 6).

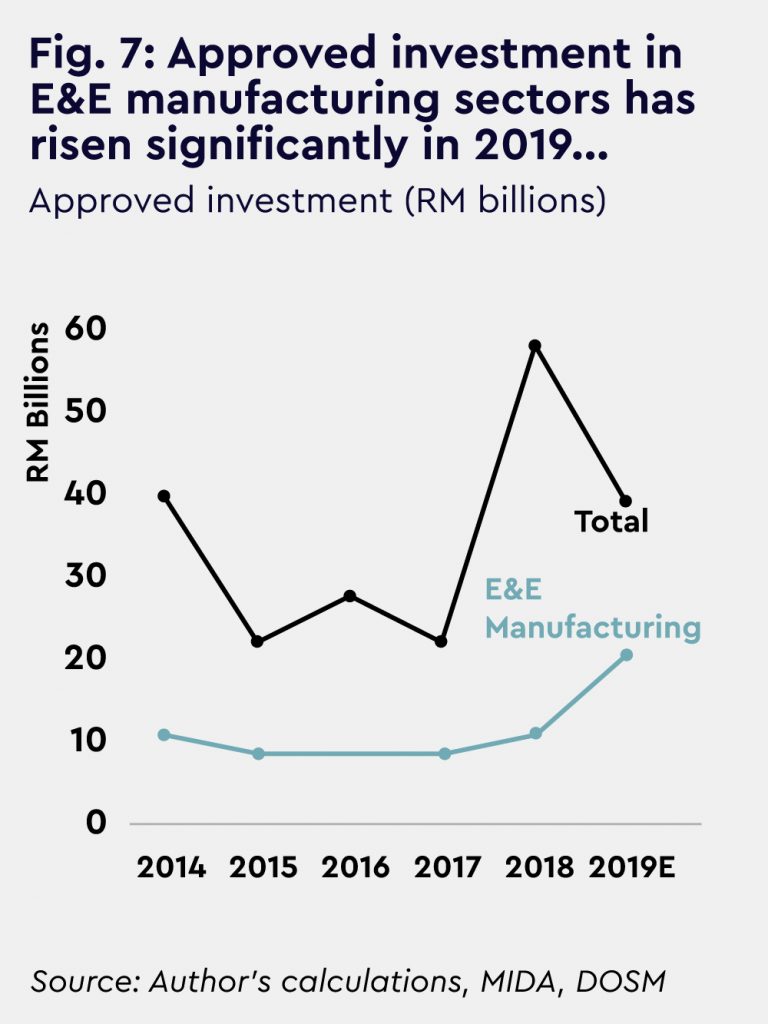

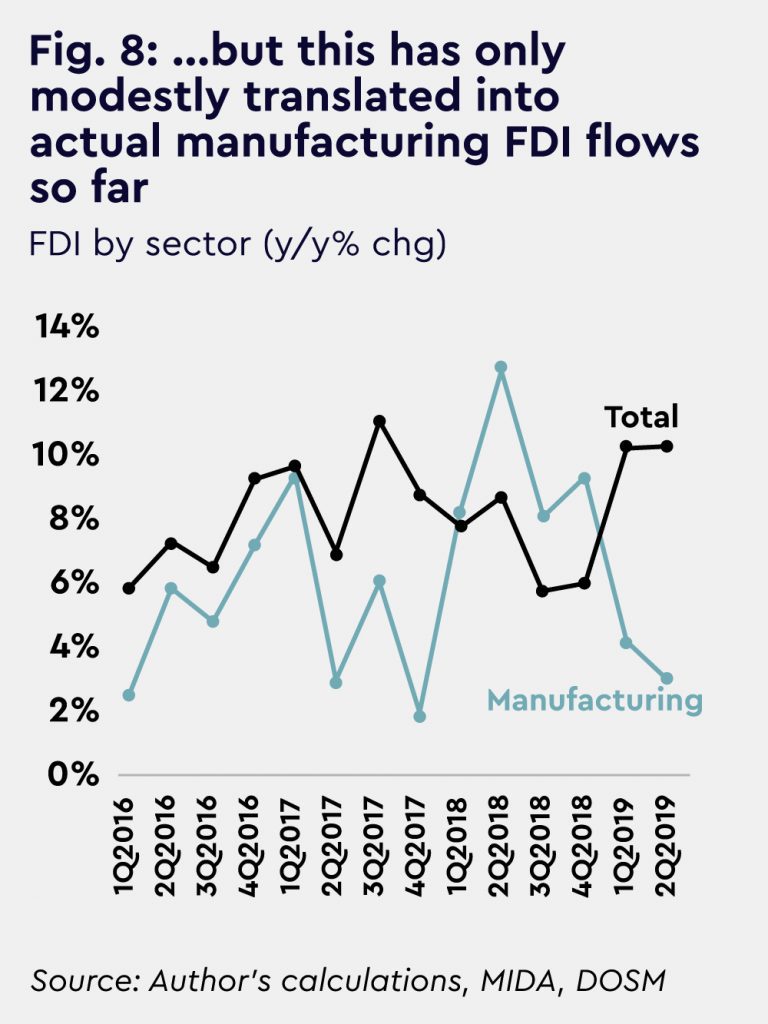

Finally, we reviewed Malaysia’s foreign investment data to look for signs of investment diversion in the period after the tariffs were imposed. Here, we used both administrative data on approved foreign investment and actual net FDI flows. Our analysis showed that approved foreign investments, especially in the E&E manufacturing sector, had risen significantly in 2018 and 2019 – suggesting strong signs of investment diversion into these specific sectors (Fig. 7). Yet this has only modestly translated into higher realised FDI flows so far (Fig. 8). Nonetheless, we anticipate these higher approved investments to eventually filter through into actual FDI flows this year, as the approved projects get implemented and as these funds actually begin to flow into the country.

Overall, for Malaysia, the available data shows that the country has indeed benefited from trade gains for specific products from diversions in both US and Chinese import demand. However, it is important to remember that these gains have not been as large as some of our regional peers, and that these gains have been relatively concentrated in a few specific product lines. Broadly, these findings suggest that so far, the positive diversion effects appear to be outweighed by the negative effects from weaker global demand and an increasingly contentious and uncertain global environment.

As such, policymakers in Malaysia and beyond need to play a much more proactive role in negating the risks of rising trade protectionism. For economies in the region, winning the trade war would entail banding together to mitigate the adverse effects from sluggish global demand and lower world trade – in addition to taking advantage of the fleeting window of opportunity afforded by trade and investment diversions. After all, despite the momentary reprieve offered by a “Phase One”, global trade challenges will only continue to intensify. Mere days after the agreement was reached with China, the Trump administration suggested that it was ready to escalate another of its many trade battles: this time with the European Union firmly in its crosshairs.

This article first appeared in the ISIS Focus 1/2020 No. 10