On 31 May 2021, on the eve of the implementation of the Full MCO, the Malaysian government announced the RM40 billion Permerkasa Plus assistance package. This article explores the main initiatives under Permerkasa Plus, provides a stocktake of past economic stimulus packages since the start of 2020, and investigates the potential for more forceful fiscal action.

Key Points:

- Out of the total RM40 billion allocated under the Pemerkasa Plus economic assistance package, only 13 percent, or RM5 billion represents direct government spending.

- Similarly, the Malaysian government has only allocated about ~5 percent of GDP (RM73 billion) in direct federal government spending across the six major economic response packages announced since the beginning of 2020.

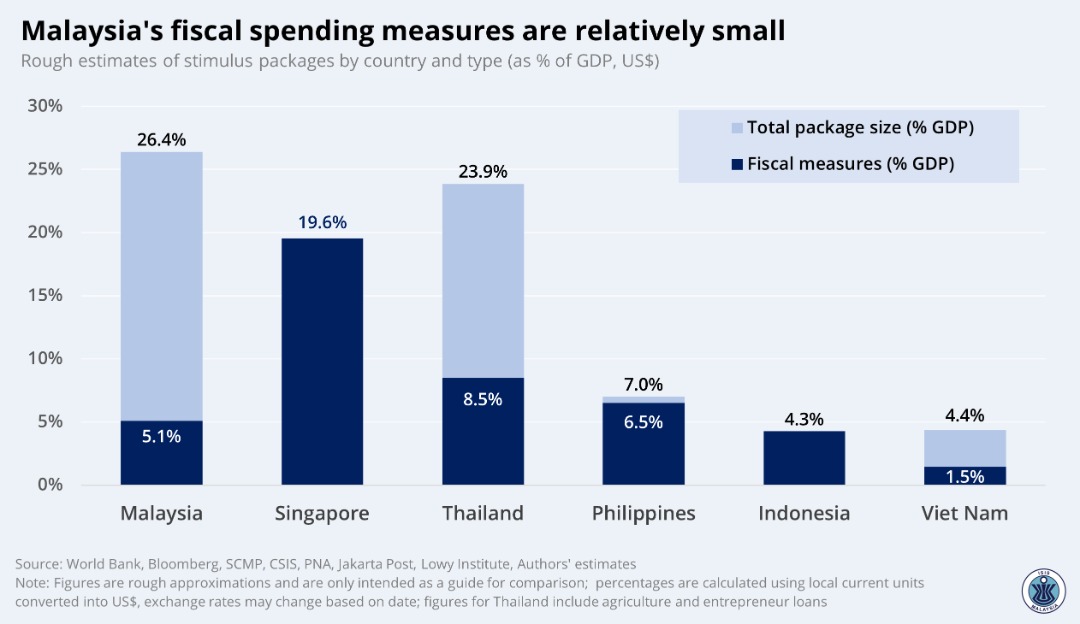

- Rough estimates suggest that Malaysia’s total fiscal spending measures are relatively low (in GDP terms) compared to major countries in ASEAN, despite having the largest total economic response package size.

- More cash support to households, a wholesale expansion of unemployment benefits, and higher infrastructure spending could have outsized economic benefits for the long-run.

1.0 Overview of Permerkasa Plus

one day before the slated implementation of the nationwide full movement control order (FMCO), the Malaysian government announced an RM40 billion (about 2.8 percent of GDP) economic stimulus package called Permerkasa Plus. Key initiatives under Permerkasa Plus include a loan moratorium for lower-income households and SMEs affected by the FMCO; supplementary income support to households under the Bantuan Prihatin Rakyat cash transfer program; and extensions of the wage subsidy program under PERKESO.

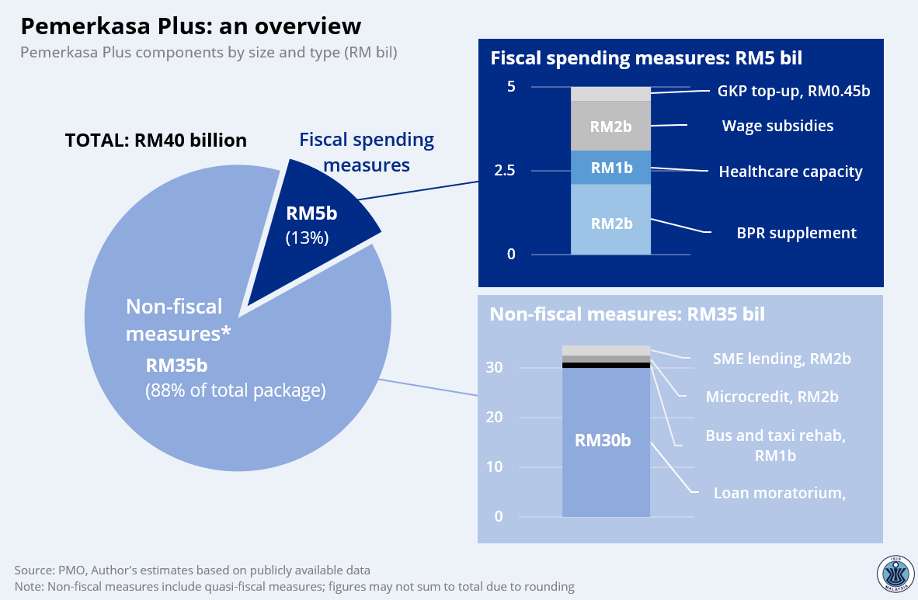

As usual, only a small proportion of Permerkasa Plus’ RM40 billion size consists of actual federal government spending (see Fig. 1). Of the total RM40 billion, only RM5 billion (13 percent of total) amounts to new fiscal spending by the government. The remaining RM35 billion (88 percent) consist of non-fiscal or quasi-fiscal measures, largest of which are the loan moratorium measures which are valued by the government at RM30 billion (Fig. 1).

In terms of fiscal measures, the largest expenditure item under the Permerkasa Plus package is the RM2.1 billion for the benefit top-up under the Bantuan Prihatin Rakyat (BPR) cash transfer program, as well as RM1.5 billion for the extension of the wage subsidy program under PERKESO (see the itemised list in Table 1). In GDP terms, Permerkasa Plus has a total package size of about 2.8 percent of GDP, but only represents about an additional 0.3 percent of GDP in government spending using official GDP estimates from the Ministry of Finance.

Fig. 1: Pemerkasa Plus package, components and amounts

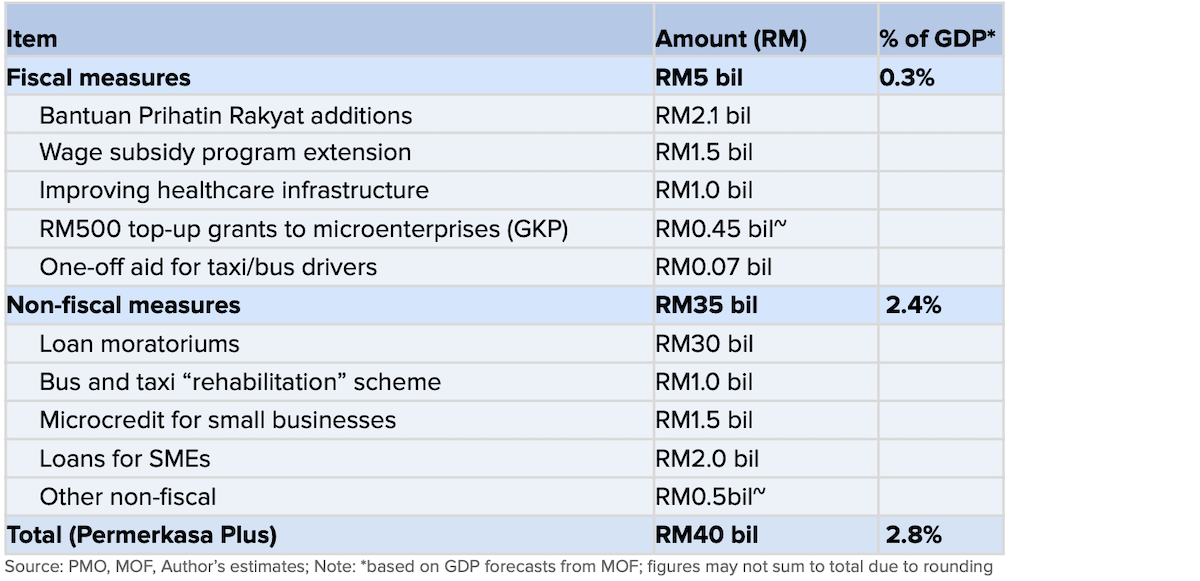

Table 1: List of measures under the Permerkasa Plus package

2.0 Malaysia’s stimulus packages and ASEAN comparisons

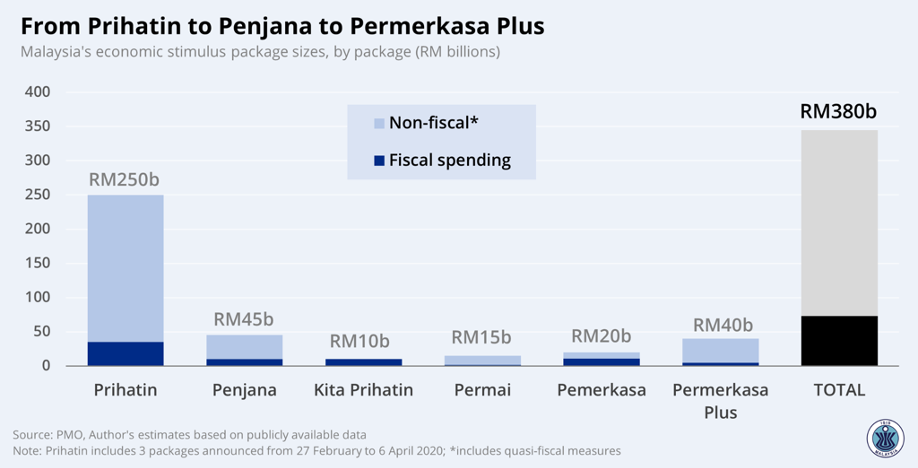

The total size of the six economic response packages the Malaysian government has announced since the beginning of 2020 is about RM380 billion—about 26 percent of GDP. This includes the RM40 billion Permerkasa Plus—along with the Prihatin, Penjana, Kita Prihatin, Permai and Pemerkasa packages (see Fig. 2). Again, despite this massive headline number, the actual amount of federal government spending represents a tiny fraction of the total headline amount. Indeed, my estimates suggest that only 15 percent of the total RM380 billion amount—or about RM73 billion are fiscal-related measures (see column labeled ‘total’ in Fig. 2).

That is, across the six major economic stimulus packages announced since the start of 2020 the Malaysian government has only allocated about ~5 percent of GDP in direct federal government spending (RM73 billion) to combat the economic impacts of the COVID-19 pandemic. Put differently, for every RM1 ringgit announced across the six packages, the Malaysian government spent only about RM0.15, or 15 sens. The remaining 75 sens are made up of non-fiscal measures—a figure inflated by measures like EPF withdrawals (valued at about RM74 billion including i-Sinar), loan moratoriums and loan guarantees (valued at about RM153 billion combined).

Comparing Malaysia’s economic response to COVID-19 with other major countries in the ASEAN region (see Fig. 3 below) indicate that Malaysia’s fiscal spending measures are relatively low (in GDP terms). Rough approximations using publicly-available data suggest that while Malaysia has the largest economic response by total package size (at about 26 percent of GDP)—the size of its fiscal measures (5 percent of GDP) fall far below Singapore (~20 percent of GDP), Thailand (9 percent of GDP) and the Philippines (6 percent). This is despite Malaysia recording far more confirmed COVID-19 cases per million than Singapore, Thailand, Philippines, Indonesia, Vietnam combined.

Fig. 2: Economic stimulus packages from February 2020 to January 2021

Fig. 3: Economic responses in the ASEAN region

3.0 More fiscal action needed to support families in need

Many of the fiscal and non-fiscal measures announced under Pemerkasa Plus represent a lifeline to many low-income households and workers heavily affected by the COVID-19 pandemic. In the past, I have recommended supplementary cash transfers and grants to microenterprises similar to Permerkasa Plus’ BPR top-ups and microenterprise grant top-ups (GKP). Likewise, the loan moratoriums and microcredit schemes will undoubtedly help hundreds of thousands of affected entrepreneurs and small businesses.

Nonetheless, the magnitude of Pemerkasa Plus is largely insufficient to combat both the economic impacts of the resurgence in COVID-19 infection rates and the implementation of a nationwide lockdown. This is made more urgent by rapidly rising COVID-19 case numbers, a partial economic recovery that has been deeply unequal—with about 750 thousand Malaysians remaining unemployed, and labour participation rates for marginalised worker groups at multi-year lows.

As such, if economic conditions deteriorate and COVID cases continue to rise, the Malaysian government needs to be much more forceful in expanding government spending. Overall, as I have argued many times before, fiscal measures should focus on expanding direct government spending in three key areas: 1) cash support to lower income households; 2) expanding and extending EIS unemployment benefits and 3) increasing infrastructure spending. Focusing on these three key areas would help more unemployed Malaysians (read here) better able to receive the assistance they need to continue searching for a new job or re-skill. It would also help low-income families access the cash support they need, while also taking advantage of lower borrowing costs to expand infrastructure spending and boost longer-term productivity.

4.0 A brief note on the Bantuan Prihatin Rakyat cash transfer program

As mentioned earlier, Pemerkasa Plus’ BPR top-ups are a good start. Survey findings from lower-income households regularly show that cash support measures (like BPR and BPN) are amongst the most effective assistance for many families and households at the lowest end of the income distribution. Yet, there is a sense that the BPR top-ups under Pemerkasa Plus (additional one-off RM500 for households earning below RM2,500 per month) are insufficient for many families to weather the impacts of a nationwide lockdown.

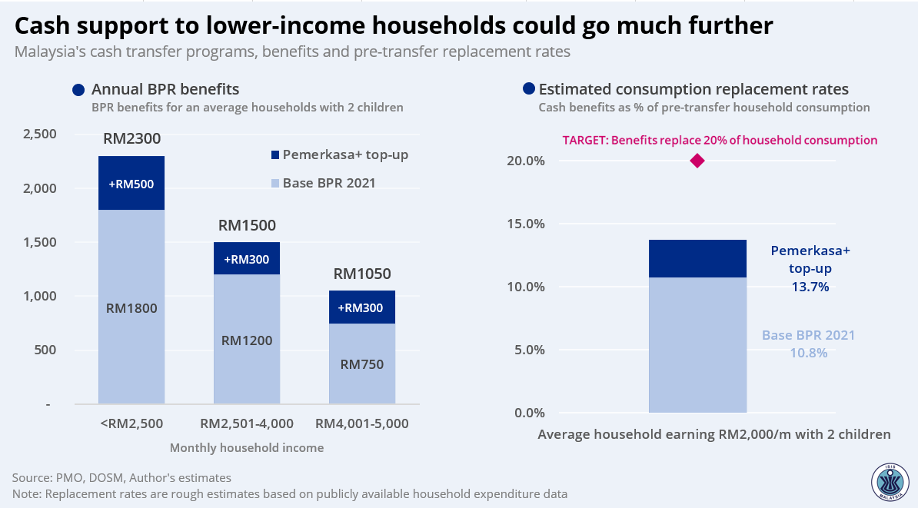

As it stands, the base BPR benefits for an average family earning RM2,500/month with 2 kids is about RM1,800 per year (see Fig. 4). The Pemerkasa Plus top-ups brings that annual BPR benefit amount to RM2,300 for a household earning RM2,500/month (with 2 kids). This represents a replacement rate of about 13.7 percent, based on back-of-the-envelope estimates using household expenditure survey data (Fig. 4).

Evidence suggests that even in normal (non-pandemic) times, expenditure replacement rates of closer to 20 percent are likely to be more effective (Fig. 4, right chart). Additionally, earlier survey evidence shows that many lower-income families earn sharply lower or even zero incomes during full lockdowns. I estimate that the RM2,300 annual BPR benefit (which includes the Pemerkasa Plus top-up) will only fully cover about 49 days of household consumption for an average household earning RM2,000/month. Moving forward, cash support needs to be more generous if and as economic conditions worsen. As a guide, estimates using household survey data suggest that a flat transfer of RM2,000 for households in the bottom 40 percent of the income distribution will cost about RM 6 billion in additional government spending.

Fig. 4: Overview of Malaysia’s cash transfer program and Permerkasa Plus top-ups

4.0 Fiscal space considerations and concluding thoughts

Of course, calls for more fiscal action are regularly opposed by anti-debt enthusiasts. Recent statements by the Ministry of Finance suggest that debt ratios currently stand at 58% of GDP—about 2 percentage points lower than the statutory debt limit of 60%. This additional 2 percentage points may translate to about RM28-30 billion in additional deficit spending that can be financed through borrowing–far exceeding the RM5 billion allocated under the Pemerkasa Plus package.

Ultimately, fiscal space is malleable. In the near-term, taking into account other federal government budgetary measures, including re-allocating and/or non-essential expenditure items and increased revenue contributions from government-linked entities could further increase fiscal space. In the medium-term, measures to increase revenue sustainability (including enlarging the tax base and tax compliance) and expenditure reform can improve longer-term debt sustainability. Any and all of these would be far more effective in improving fiscal sustainability in the longer-run compared to myopic calls for near-term austerity.