by Ahmad Afandi, Dr Reuben Clements and Zayana Zaikariah, June 2024

About ISIS Malaysia

The Institute of Strategic & International Studies (ISIS) Malaysia, established on 8 April 1983 as an autonomous research organisation, focuses on foreign policy, security, economics, social policy, nation-building, technology, innovation and environmental studies.

As a premier think-tank, ISIS Malaysia engages in Track-Two diplomacy and fosters regional integration and international cooperation through networks, such as ASEAN Institutes of Strategic & International Studies (ASEAN-ISIS), Pacific Economic Cooperation Council (PECC) and Network of East Asian Think-Tanks (NEAT).

About the contributors

Ahmad Afandi is a fellow in the Climate, Environment and Energy department at ISIS Malaysia. His primary research interests lie in climate resilience, biodiversity and environmental governance. Afandi has over 10 years of experience in consulting and research, where he did several high-level projects on strategic planning, policy studies, spatial planning and technical studies in Malaysia. His most recent work includes reviewing the National Policy on Climate Change 2009 for the Ministry of Natural Resources and Environment Sustainability. He also serves as an environmental lead for the CSO-SDG Alliance. Afandi holds an MA in Sustainable Development Management from Jeffrey Sachs Centre on Sustainable Development, Sunway University, and a BSc from Lincoln University, Canterbury, New Zealand.

Dr Gopalasamy Reuben Clements is a sustainable finance specialist with the Zoological Society of London (ZSL), where he currently develops and manages ZSl’s nature-based solutions (NBS) portfolio in Southeast Asia. Reuben has 18 years of experience as a conservation scientist and finished as a full professor after an eight-year academic career in Malaysia. After serving as vice-president of the Malaysian non-profit Rimba, Reuben co-founded Nature Based Solutions (NBS), a Malaysian developer and implementer of NBS projects. Reuben has an MSc and BSc in Biology from the National University of Singapore, and a PhD in Conservation Science from James Cook University, Australia.

Zayana Zaikariah is a researcher in the Climate, Environment and Energy department at ISIS Malaysia. Her research interests revolve around environment and sustainability with a focus sustainable finance and flood mitigation and adaptation. She studied at the Australian National University and majored in environment sustainability.

Acknowledgments and special thanks

We would like to extend our special thanks to Tan Sri Prof Zakri Abdul Hamid, the fifth holder of the Tun Hussein Onn Chair, for convening the roundtable discussion and moderating the panel session at PRAXIS 2023, as his efforts have significantly contributed to the development of this policy brief.

We also wish to acknowledge the contributions of the following people and organisations during the roundtables and forums, which greatly aided in the formulation of this policy brief:

• Zoological Society of London

• Climate Governance Malaysia

• Datuk Darrel Webber, Climate Adviser to the Sabah State Government

• Yayasan Hasanah

• Bursa Malaysia

• Lestari Capital

• Habitat Foundation

• Reef Check Malaysia

• Alliance Bank Malaysia Berhad

• Mindscape Training & Consultancy

Key takeaways

- Malaysia is grappling with deforestation challenges that pose a threat to its global standing, resource security and market access. The persistent issue stems from an incentive and disincentive structure that inadequately safeguards public goods, notably ecosystem services from state governments’ heavy dependence on land-based revenue.

- The concept of a nature-positive economy seeks to create a conservation market that channels capital towards conservation, primarily through innovative financing mechanisms, including a responsible carbon-trading system. Malaysia is poised to offer high-quality nature-based projects but needs to instil confidence among market participants and create an enabling environment.

- Addressing the incoherent policies in climate change and biodiversity requires shifting towards an equitable fair-share contribution model among state governments that aligns and harmonises federal and state-level targets with consensus and provision of technical support. This model could enhance existing economic instruments by compensating and incentivising states for conservation.

- The current incentive and disincentive structure that are not aligned with conservation outcomes needs to be changed by deploying various carefully designed “first-best” policy instruments that internalise negative externalities by polluters, including carbon pricing and resource pricing, to induce behavioural change among market actors and better protection of public goods.

- A strong oversight is required on carbon trading through clear policy and regulatory framework at federal and state level, addressing the jurisdictional complexities on carbon sovereignty, harmonising carbon legality as well as technical matters. Cultivating a business ecosystem for conservation requires strengthening domestic expertise and capacity alongside reviewing existing land laws to facilitate long-term conservation initiatives.

- The ambiguity surrounding Nature-based Solutions NbS requires Malaysia to have a strategy that suits national circumstances, including definitions, capital prioritisation in critical ecological areas, delivery of co-benefits and a communication plan. The latter should align with a wider politically sound and impactful narrative for a nature-positive economy, offering direct social benefits while contributing to broader climate and biodiversity objectives.

1. Background

1.1 Introduction

A nature-positive economy (NPE) represents an economic concept that places nature conservation at its core to mitigate climate change and curb deforestation. This concept is novel in that it seeks to create a market for conservation by utilising various innovative financial instruments – such as carbon credits, biodiversity credits and payments for ecosystem services – equitably and responsibly to achieve positive conservation outcomes.

These outcomes lead to ecosystem services beneficial to local communities as they yield direct impacts, such as increased food, medicinal and harvesting resources alongside job opportunities. Indirect benefits include providing buffers against disasters, microclimate control, as well as cleaner air and water. NPE envisions a state of play where governments and businesses find a stronger rationale and incentive to prioritise the restoration and conservation of natural capital, including forests, over traditional extractive industries and the construction of grey infrastructure.

1.2 Rationale for NPE

Malaysia is one of the world’s 17 megadiverse countries. Our terrestrial habitats include a range of wild plants and animals, such as dipterocarp forests and montane forests, while our coastal and marine areas support vital ecosystems, such as mangrove forests and coral reefs. These natural habitats support a wide range of floral and faunal groups, which contribute to the richness of the biodiversity. This wealth of natural capital plays a crucial role in preserving the natural environment and sustaining life-support systems.

Similar to the trajectory of other developing countries, a large proportion of Malaysia’s original forest cover has been replaced by other forms of land use – particularly for agricultural and urban expansion. Despite this, 54.58% of the land area remains under forest and tree cover1. While Malaysia has consistently undertaken initiatives to combat deforestation, such as establishing more protected areas, limiting palm oil cultivation regions and instituting inter-governmental fiscal transfers, independent analyses suggest alarming trends against these efforts. More than two million hectares of forests have been earmarked for clearance, with 76% designated for monoculture plantation of timber latex clones. This threatens to reduce national forest and tree cover to 47.37%2.

While often framed as an environmental issue, deforestation and biodiversity loss also have far-reaching strategic and security implications for Malaysia in terms of international relations, economics, trade and development:

- Ramifications for international commitments and reputation: Malaysia has an international stature for biodiversity, placing it under much scrutiny because of widespread deforestation brought by the agri-commodity industry, especially palm oil. The country depends heavily on its forests to fulfil various international commitments, including the 50% forest and tree cover pledge made at the Rio Earth Summit in 1992, as well as climate-related commitments, such as its Nationally Determined Contribution (NDC) under the Paris Agreement and aspirations to become a net-zero nation by as early as 2050. As of 2019, Malaysia’s forest sequesters about 65% of its greenhouse gas emissions3.

- Meeting sustainable market and trade requirements: as a small and open trading economy that is highly integrated into the global supply chain, Malaysia is subjected to various supranational trade policies, such as the European Union Deforestation Regulation (EUDR)4. Under the EUDR, those wanting to enter the European Union (EU) market must demonstrate that their products are legal and deforestation-free through a due diligence process that is applicable to seven commodities, including palm oil. Under the EUDR, countries will also be assigned a risk level for deforestation, which informs the scope of the subsequent due-diligence process. As Malaysia is a major palm oil exporter, the EUDR poses risks for companies in terms of delays, fines and loss of market access on top of higher compliance costs. Without jurisdictional intervention to manage deforestation risks, smallholders may lose market access to the EU supply chain. Similar regulations are expected to be developed elsewhere, beginning in advanced industrialised countries that aim to tackle deforestation in their supply chains, such as the US5 and UK6.

- Ensuring resource security and building resilience: ecosystem services provided by our biodiversity and natural endowments are vital for building resilience against climate hazards, environmental risks, food insecurity and future zoonotic diseases. However, ongoing habitat loss and degradation are exacerbating our vulnerabilities. Official reports have confirmed that deforestation and development of monoculture plantation in hillsides and slopes have contributed to flooding and debris flow in few localities in Kedah7. Furthermore, the country’s key economic sectors, including agriculture, tourism and fisheries, rely heavily on the wider biodiversity ecosystem. For instance, the RM130 billion oil palm industry relies on red weevils for pollination, while durian production depends heavily on pollination by fruit bats, both of whose forest and cave habitats are under threat.

Deforestation in Malaysia is driven by a combination of economic, market and societal factors. Exacerbating this is the centralisation of government revenue which contributes to the federal-state jurisdictional dichotomy on natural resources management. Under the Federal Constitution, jurisdiction of natural resources, such as land, water and forests fall under the responsibility of state governments. While state governments are encouraged to promulgate laws and formulate policies pertaining to land and forestry matters, state governments rely heavily on narrow revenue streams from land and natural resources. This includes logging, mining and land clearance, along with income from oil palm land premiums and timber royalties.

On average, land-related revenue, including assessment tax, quit rents and forestry premiums constitutes between 50% and 90% of state government revenues. For example, forestry and land revenue constitute the majority of Pahang’s annual revenue, accounting for 70.5% in 2021 and 68.9% in 2022. The revenue gap between the federal and state governments is also enormous. In 2022, all states combined earned RM30.8 billion – amounting only to 10.5% of the federal government’s revenue of RM294.4 billion8.

The absence of well-aligned incentives and disincentives in the fiscal framework exacerbates environmental risks. A notable example involves the pivotal role forests play in natural flood protection. Despite the adverse consequences of deforestation-induced floods, state governments do not bear the financial repercussions. Instead, the burden falls on the federal government to fund flood-mitigation projects and disaster-relief measures.

In essence, NPE seeks to address these issues by establishing a market for conservation that creates incentives for both government and market participants to safeguard natural habitats. It achieves this by creating an enabling environment that leverages on innovative financial and market-based instruments to increase the flow of capital towards conservation projects. Besides reducing deforestation risks, increasing preservation and restoration of natural capital can continue to support the nation’s economic growth, provide essential goods and services for the wellbeing of all Malaysians, while serving as a viable habitat for Malaysia’s rich biodiversity. Furthermore, these natural assets continue to enable Malaysia to fulfil its international environmental commitments, addressing transition risks associated with the global market shifts towards sustainability, while building resilience against shocks and stresses, such as climate-related disasters. The latter will likely increase economic efficiency by reducing the nation’s expenditures on managing disaster risks, particularly expensive engineering projects, such as flood mitigation and disaster aid, especially at times when the government is under fiscal constraints.

2. Status of conservation funding and financing in Malaysia

Securing adequate funding for environmental conservation posed a persistent challenge for Malaysia. Despite the public sector being the primary source for environment-related expenses, budget allocations for conservation efforts have stayed low, below 1% of the GDP. This does not reflect the substantial contributions of biodiversity and ecosystem services to the economy and society. Though funding capacity has diversified through the establishment of various trust funds, such as the National Conservation Trust Fund for Natural Resources, the current amount is insufficient. Meanwhile, despite Malaysia previously receiving financial aid from multilateral organisations, as an upper-middle-income country, it has consciously diminished its reliance on international finance for its development. Notably, Malaysia is no longer a net recipient of official development assistance. As Malaysia transitions into a developed country, accessing multilateral and bilateral funds will become increasingly challenging. This requires innovative approaches to augment funding and financing for environment and biodiversity.

The government has prioritised the deployment of economic and financing instruments for climate and environmental policies9. Since the late 2000s, the country has witnessed a significant increase in the utilisation of economic tools to address environmental challenges. Malaysia is grappling with the repercussions of climate change and environment degradation, characterised by rising temperatures and more climate-related disasters. Recognising the climate imperatives to address these issues, the government has laid out various policy options in the 12th Malaysia Plan, namely the adoption of carbon-pricing instruments, carbon markets, ecological-fiscal transfer (EFT), payment for ecosystem services (PES) alongside promotion of green-financing schemes and rationalisation of fossil fuel subsidies.

The current fiscal arrangement and mechanisms are inadequate to incentivise state governments to conserve and restore their forests. The federal government has initiated EFT in 2019 with an initial amount of RM70 million and increased it to RM150 million in 2023 to channel conservation funds to state government. While this provided a good starting point, the allocation, especially after being divided among 14 states, hardly matches the revenue from forests through premium and cess from land, as well as royalties from timber and other forest-based products. As such, revenue from conservation finance mechanisms, with EFTs, must be comparable or exceed opportunity costs from extractive industries that involve forest clearance. This will make conservation a greater business case than the exploitation of forests. But the derivation of opportunity costs must go beyond strictly monetary gain and include social aspects, such as job creation and social mobility. This is pertinent as different regions and states in Malaysia have different development needs.

Among existing financial mechanisms, carbon-offset projects have arguably attracted the most interest and perceived as providing the highest potential, despite greenwashing concerns. This heightened interest could be attributed to the growing presence of private sector entities that aim to meet net-zero targets and improve ESG performance. These entities, especially those in hard-to-abate industries, are actively seeking high-quality carbon offsets, either voluntarily or as part of compliance efforts. The World Bank reports that more than 47 countries and 26 sub-national jurisdictions have carbon-pricing initiatives, boosting demand for carbon credits10. The voluntary carbon-offset market, valued at US$2 billion in 2021, is forecast to grow to US$10-US$40 billion by 2030, transacting 0.5–1.5 billion metric tonnes of carbon dioxide equivalent from the current 500 million tonnes11.

Malaysia introduced its voluntary carbon market in 2022, which is also the world’s first shariah-compliant market. However, the lack of domestic carbon projects resulted in only two nature-based projects, both from Cambodia. The first is the Kuamut rainforest conservation project, a local carbon project which is expected to begin selling carbon credits in the Bursa Carbon Exchange some time in 202412. Notwithstanding, Malaysia currently lacks a carbon-pricing mechanism. Although the development of such a mechanism is underway, the need for a domestic emission-trading scheme is crucial to increase the demand for carbon credits. Even then, despite a modest price of US$5.80 per tonne of CO2, the investable carbon per year for natural forests in Malaysia might not be sufficient to offset the opportunity cost for all Malaysian the states13, not considering the development and maintenance costs of the carbon projects.

Value of natural capital extends far beyond carbon and offers the opportunities to explore other conservation-financing instruments. Besides carbon storage, preserving natural capital offers numerous other positive externalities, including water purification, pollination, biodiversity and flood protection. While it is foreseeable that nature-based carbon credits will still play a major role in conservation financing, the rationale for conserving natural capital extends well beyond carbon and overemphasising on carbon monetisation could lead to unintended incentives for nature conservation. For example, areas with low carbon sequestration rate can still potentially hold significant biodiversity, cultural and societal value. In fact, given Malaysia’s status as a mega-biodiverse country with various ecosystems, it could benefit more from nature and biodiversity credits.

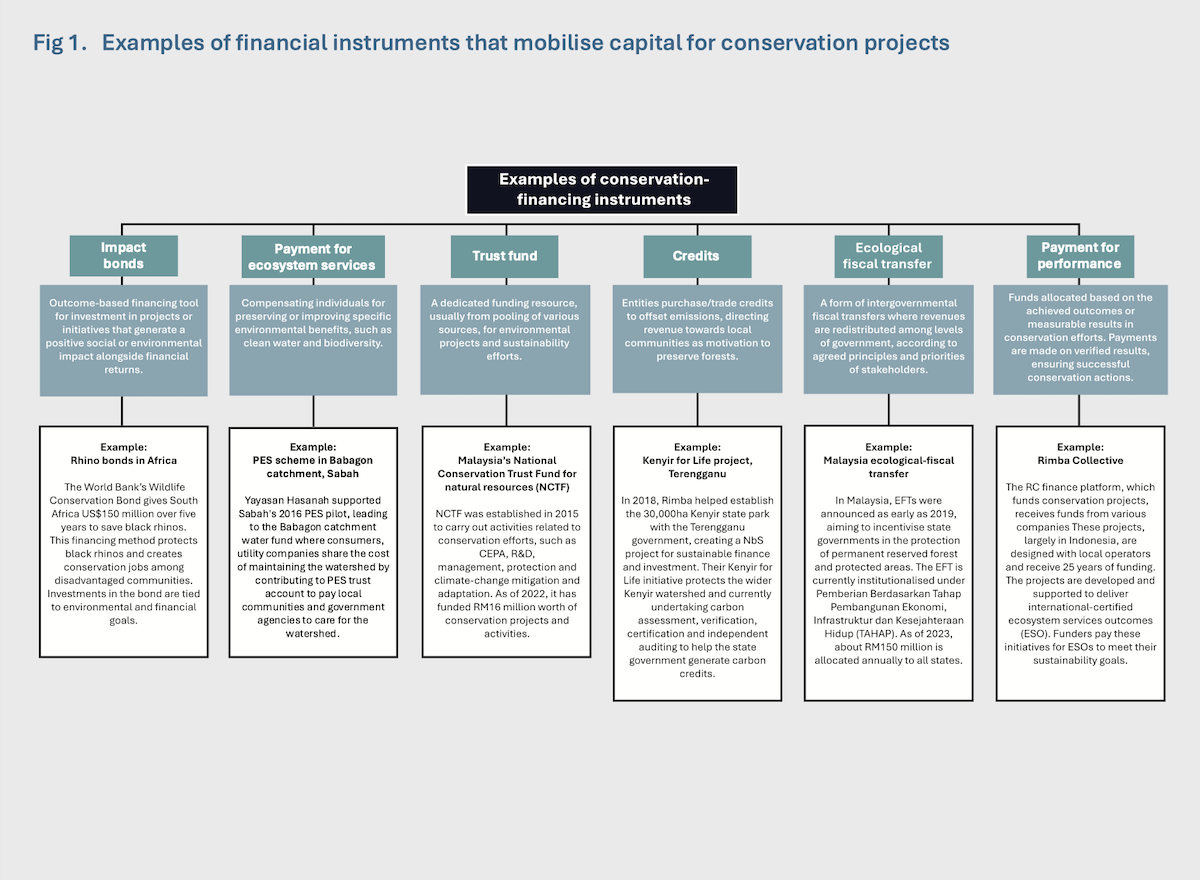

It is imperative to explore other finance mechanisms that are tailored to local needs, contexts and circumstances. The Conservation Finance Alliance classifies at least 30 known conservation finance mechanisms, including grants, market-based mechanisms, return-based investments and economic instruments14. The design and implementation of these instruments is not without challenges, as they tend to be more intricate than carbon, which has a straightforward currency i.e. GHG emissions. While there have been plenty of successful cases of forest carbon projects, there are also several examples of international conversation projects that utilise other instruments (Figure 1). Ultimately, there is no one- size-fits-all model for how conservation financing works. It is highly dependent on impact, conservation outcomes, financing model, buyer willingness and local context. The major challenge in Malaysia remains on how to create an enabling environment based on national circumstances that could channel capital into conservation projects, which require the most intervention to generate local impact.

3. Challenges in transitioning towards NPE

The shifting investment landscape and rise in carbon pricing mechanisms in various countries have resulted in a spike of interest from market actors in financing conservation projects, including purchasing nature-based carbon credits in Malaysia and the Southeast Asia. To justify their investments, they seek assurances on project impacts, permanence and successful implementation. Nonetheless, there remains several interconnected challenges at the domestic level on policies, governance and market that have eroded confidence among potential investors and credit buyers in the Malaysian market.

3.1 Federal-state dynamics in environmental policies

The dynamics of current federal-state relations are impacted by issues related to jurisdiction over land and natural resources, overcentralisation of federal resources, ineffective engagements and a lack of frameworks that enable participatory policymaking. These interacting issues often result in policy conflicts and implementation challenges.

3.1.1 Trickling down federal targets, policies

The federal-state dynamic has created a disconnect between policies at the federal level and implementation at the state level. The 50% forest cover pledge and targets made under the Aichi Biodiversity Target to ensure 20% terrestrial protected areas have not been effectively translated at the state level. This includes more recent targets on climate change, such as the NDCs under the Paris Agreement. Without effective federal-state engagement and efforts to improve governance across all levels, state governments will not fully embrace their role and responsibilities delivering on the NDCs and other international environmental commitments. While state governments set their own targets and policies through structured plans and local plans, such targets are often not in sync with federal targets and commitments. An example can be seen in the Central Forest Spine Master Plan, a federal initiative launched in 2009, which aims to reconnect fragmented forest landscape in Peninsular Malaysia but has not been effectively adopted at the state level until more recently.

3.1.2 Policy conflict, incoherent

Conflicts in policies related to the environment and natural resources persist at various levels of government, with a notable instance within the spatial planning framework for the country. Specifically, the Environmental Sensitive Area (ESA) Framework, established in 2005 under the National Physical Plan under the Town and Country Planning Act 1976, often serves as a flashpoint for such conflicts. ESA employs a three-tier classification system, restricting certain designated areas, such as forest reserves and protected areas as well as habitat types like wetlands and peat swamps, from any developmental activity, permitting only minimal impact activities, such as research, recreation or at most sustainable logging for production forest reserves15.

However, not all state governments have uniformly embraced the federal ESA classifications in their structure plans. States retain the flexibility to determine classifications based on their needs and circumstances. Notably, some states like Kelantan have opted to eliminate all ESAs designation from their structure plans and district local plans16, a decision that raised concerns from the federal government and criticised by civil society organisations. Furthermore, loopholes exist in which activities such as timber-latex clone plantations, mining and quarrying within Permanent Reserved Forests are legally allowed under the state forestry enactments through the permit system. This creates a divergence between policy objectives and on-the-ground practices.

Policy conflicts also extend to the federal level, exemplified by the prime minister’s announcement permitting rare-earth mining in environmentally sensitive areas (ESA)17. This decision directly contradicts the land use policies outlined in the National Physical Plan, underscoring the existence of policy conflicts even at the highest level of government.

The multitude of issues highlighted above contributes to incoherent policies in natural resource management and forestry, posing a significant risk of eroding confidence among market players. This includes financiers, fund managers and carbon-credit buyers who actively seek assurance in the permanence and sustainability of nature-based projects. The lack of policy coherence and the existence of legal loopholes create an environment of uncertainty, undermining the reliability and credibility of such initiatives in the eyes of these key stakeholders. The resulting instability may deter investments and partnerships essential for the success of projects aimed at environmental conservation and carbon sequestration.

3.1.3 Fiscal-transfer effectiveness

A lack of effectiveness in engagements and participatory planning at the state level have also resulted in implementation challenges to EFT. While the federal government designated RM200 million annually in 2023 for distribution to all states18, a pervasive lack of clarity on the eligibility, selection criteria, disbursement procedures and intended usage of the funds persists in most states. Perak, for example, allegedly did not receive any fund at the time of writing. Conversely, Sabah reportedly found RM20 million in its coffers without prior notification, creating confusion about the purpose of these funds.

Such instances of miscommunication highlight a substantial hurdle in developing a robust and responsible carbon-trading system for the country, particularly when jurisdiction over carbon remains ambiguous. Furthermore, a level of distrust persists among states regarding the federal government’s role in managing revenue generated from carbon trading. This distrust is partly rooted in unresolved historical issues, particularly for Sabah and Sarawak, stemming from the 1963 Malaysia Agreement.

3.2 Lack of policy, regulatory framework on carbon trading and markets

Although there is an increase in regulatory focus on carbon markets globally, in Malaysia, the carbon-market landscape is currently unregulated while lacking proper oversight. To date, there is no specific carbon-trading law in place. While carbon-trading activities are mainly seen in the Bursa Carbon Exchange (BCX) that was launched in 2022, its rules offer specific instructions for carbon trading within the exchange, which solely addresses the operational side and only applies to its participants, such as operators, traders, suppliers and brokers. It does not govern the entire carbon market community in the country. There are several broader issues regarding the lack of policy and regulatory framework on carbon trading in Malaysia.

First, Malaysia is still without a carbon-pricing system, although a feasibility study by the Ministry of Finance and World Bank is on the way. Furthermore, the current globally low price of nature-based carbon credits that hovers around US$1-US$1.50 provides little incentive to engage in conservation19. As such, it creates a challenge to increase the supply and demand for domestic nature-based carbon projects. While the government has offered several financial incentives, this is insufficient to drive the uptake, with the minister of National Resources and Environment Sustainability expressing his disappointment in Malaysian corporations for their lack of engagement in carbon-credit initiatives20.

Second, there is jurisdictional complexity surrounding the question of carbon sovereignty, a.k.a. if carbon falls under the purview of the federal or state government. While carbon falls under state jurisdiction, potential conflict arises with other regulations, such as the Environmental Quality Act or the upcoming climate-change bill that addresses carbon as a form of pollution. This situation also adds another dimension to the federal-state jurisdictional dichotomy, as state governments are eager to engage in carbon trading as a means of generating revenue, while the federal government prefers to keep carbon within national borders to meets its Paris Agreement targets and net zero aspirations.

Third, the absence of a formal mechanism to record carbon-trading transactions beyond the BCX, such as a national digital carbon registry, poses technical issues, such as the risk of double counting and the need for corresponding adjustments under Article 6 of the Paris Agreement. This lack of clarity extends to difficulties of tracking carbon stocks within the country, whether in national and corporate inventories or with overseas buyers. One solution could be restricting carbon trading to only domestic schemes, which could motivate the government to promote the Malaysian Forest Fund initiative that aims to incentivise carbon trading domestically. But ultimately, carbon is a state matter and it is assumed that states can participate in international markets and engage buyers willing to pay for higher prices. The absence of domestic carbon prices also hinders comparison with international prices.

Last, there are various concerns surrounding the credibility of carbon markets, in relation to permanence in verifying the environmental and social benefits in carbon-reduction projects and their lasting impact. Conflicts with indigenous and local communities arise because of differing land tenures and native customary rights, potentially leading to disputes over project implementation and benefits distribution to broader concerns about climate justice and equity. While certificates, such as Verra and Gold Standards, exist to ensure rigorous environmental and social criteria (which also face their own integrity and credibility issues21), adherence to these standards is not mandatory across Malaysia, relying instead on voluntary compliance and oversight outlined in the national VCM guidelines or respective state requirements. Of utmost concern, however, is the absence of a dedicated agency tasked with overseeing these matters.

The complexities and challenges surrounding carbon trading do not prevent States from moving ahead in formulating their own legal instruments to facilitate carbon trading. For instance, Sarawak has enacted the Forest (Forest Carbon Activity) Rules 2022 that provides a regulatory framework and outlines procedural steps for forest-carbon projects in the state, addressing various issues, such as real emission reductions, benefit sharing with native communities, carbon registry and corresponding adjustments22. Despite this positive step, uncertainties persist regarding how other states will develop their own carbon-related policies and align them with federal guidelines and international standards, compounded by the absence of federal-level registry and reporting mechanisms to UNFCCC.

3.3 Absence of domestic market, conducive business environment

At present, only a few nature-based projects have effectively sold carbon credits or secured various forms of conservation financing. So far, for carbon credits, only one project can be deemed “successful”– Kuamut Rainforest conservation project in Sabah. Initiated in 2015, the project was set to generate more than 14.5 million Verified Carbon Units across 30 years by mitigating and removing carbon dioxide emissions23. Although this is a positive trend, its duration of nearly 10 years highlights the complexities and difficulties of creating nature-based carbon projects and scaling them up across the nation.

3.3.1 Shortage of domestic expertise and human capital for project execution

Developing conservation projects, including carbon-based projects, is an intricate process demanding considerable resources and manpower. It encompasses various steps, such as feasibility assessments, emissions measurement, validation, stakeholder engagement and project execution. Currently, a well-established ecosystem providing domestic expertise and labour for carbon projects is absent in Malaysia, compared to more established markets, such as the Malaysian Sustainable Palm Oil (MSPO) certification and Environmental Impact Assessment (EIA). To illustrate, there are only two registered Verra-certified consultants in Malaysia. Many interested parties will need to rely on foreign expertise, which increases significantly project costs, poses logistical challenges and might create gaps through the lack of local context.

3.3.2 Lack of support for development of nature-based projects

Additionally, there is a lack of supply side incentives from the government, such as grants and seed funds, to support the development of nature-based carbon projects in Malaysia by interested parties, including civil society and community-based organisations. Existing incentives are geared towards demand-side initiatives, primarily benefitting corporate entities and businesses engaged in conservation projects, such as the Forest Conservation Certification under the Malaysian Forest Fund. Furthermore, commercial banks exhibit reluctance to finance conservation projects, primarily because of their association with high risks and assessing receiver credit score despite the promising combined revenue from sale of blended finance instruments that include carbon credits, biodiversity credits and PES schemes that could be used to service the loan or bonds.

3.3.3 Capacity, bureaucracy at state level

The success of carbon projects and payment-for-success schemes, such as green bonds, requires significant capacity at the state level to ensure sustainability, especially since most projects require huge landscape areas spanning thousands of hectares over the span of decades. The severe lack of capacity, resources and expertise at the state and local level could affect the success rate and feasibility of these initiatives. In addition, ongoing perceptions of rent-seeking and corruption at the state level might hinder the attractiveness and success rate of financial instruments to meet climate, biodiversity and social-related objectives.

Bureaucratic processes and regulations pertaining to land tenure and the granting of management rights at the local level often act as deterrents for stakeholders seeking to initiate and oversee projects. To illustrate, Indonesia’s Minister of Environment offers concessions to interested parties to undertake land-based projects. This is accomplished by issuing social forestry licenses, which permit communities to propose and implement various conservation initiatives tailored to their preferences. These initiatives encompass full conservation, forest restoration programmes, or agroforestry projects spanning a substantial 90-year duration. In contrast, Malaysia lacks a similar framework, with such arrangements predominantly confined to protected areas such as the establishment of state parks.

3.4 Weak incentive structure for businesses to minimise environmental harms

Governments can utilise a range of policy instruments to achieve climate and environmental objectives. In Malaysia, the dominance of incentive-based mechanisms, such as financial schemes and tax incentives, demonstrate a softer approach to affecting behavioural change, in contrast to harder regulations, which compel or issue a strong economic case for change.

This softer approach, unfortunately, results in insufficient incentives for businesses to engage in conservation through policy instruments that correct market failures by ensuring they internalise external costs, such as carbon pricing and biodiversity offsets. For example, states in Australia have established mandatory biodiversity offset schemes that require developers to offset their biodiversity loss by following a mitigation hierarchy to demonstrate their efforts in avoiding and minimising ecological impacts on site before resorting to offsets24. Offsets can be done through restoration of developer-owned land, purchasing high-integrity biodiversity credits or contributing to a national conservation fund.

Malaysia has promoted similar policies to ensure a “no net loss of biodiversity” in development projects under the National Policy on Biological Diversity 2016-2025 and the National Physical Plan 4, yet these policies are far from being institutionalised at the federal and state levels. Apart from complexity in the implementation of such policies, this can also be attributed to Malaysia’s traditional inclination towards using carrots rather than sticks to spur behavioural change, such as offering green incentives to the business community over enacting strong regulatory instruments. However, this approach is not uncommon in developing countries, where looser environmental regulations are preferred for economic and political gains. Nevertheless, the absence of such policy and mechanisms does not provide enough incentive for polluters to fund conservation efforts.

Another noteworthy example is the concept of payment for ecosystem services (PES). Despite steady interest of PES in Malaysia, there is a paucity of PES programmes, with only one in operation in Perak and one in development in Sabah25. Globally, there are more than 500 PES schemes with diverse approaches, in which 70% are centred around services related to watersheds for ease of implementation26. Yet in Malaysia, adoption of these schemes encounters significant challenges primarily because Malaysia has one of the lowest water tariffs in the world27 and rationalisation of water pricing is a highly politically sensitive matter. These factors create limited incentives for both businesses and the government to engage in water-based PES programmes.

4. Policy recommendations

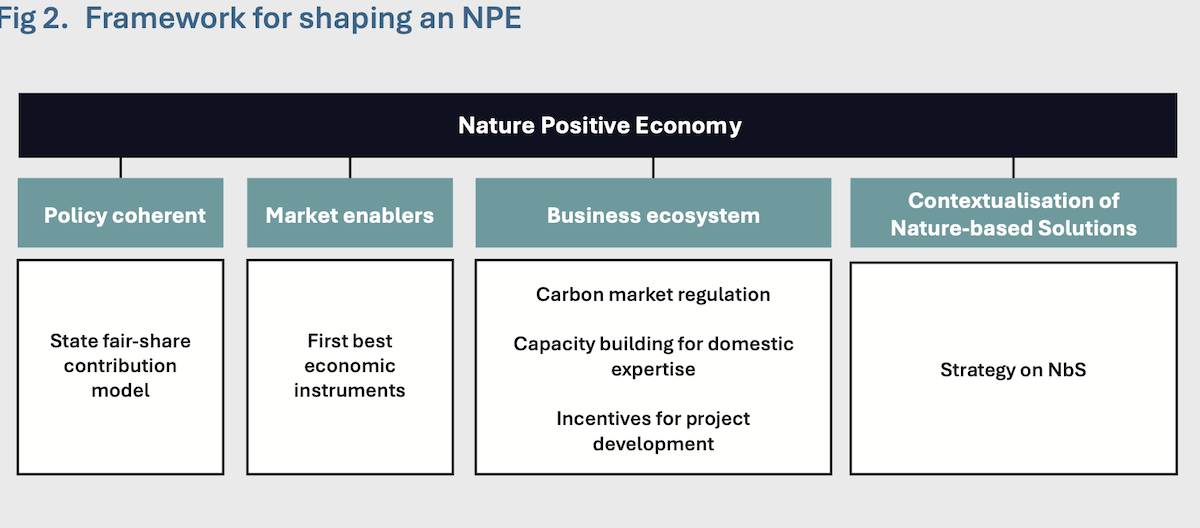

This paper presents four overarching recommendations within the realms of policy, regulatory frameworks, incentive structures and market dynamics, aimed at fostering a NPE (Figure 2).

4.1 Developing fair-share contribution model for state governments

Harmonisation of environmental targets, particularly on land and forestry, is required to address conservation policy incoherence. A viable solution involves implementing a fair-share contribution model, wherein each state is assigned a “fair share” of responsibility for preserving its forests. This approach mirrors the concept of “common but differentiated responsibilities” often associated with multilateral environmental agreements. This concept recognises that while all parties share a common goal in addressing modern environmental challenges, they might have different levels of historical responsibility, capacity and resources to do so. Hence, the fair-share contribution model should not just be based on environmental criteria, such as existing forest cover, protected area size and carbon-pool capacity, but also include other multi-dimensions for development, such as GDP, income level, poverty and infrastructure. Regardless of the method used to determine these equitable contributions, the general idea is that environmental contributions and targets need to be established for each state and these need to be aligned with federal targets.

In this process, it is imperative to increase the awareness and buy-ins from state governments, especially on their roles in fulfilling international obligations, such as the NDCs, forest-cover pledge and protected-area targets, as well as understanding their challenges and supporting their needs to meet these targets. This must be accompanied by effective engagement and participation for state governments from the outset, especially when designing economic instruments, such as carbon pricing. Support should also be provided in the form of infrastructure and databases, such as the greenhouse gas data inventory at the state level. As exemplified in Sabah’s case where this data was vital for understanding the level of carbon stock and informing its fair-share contribution model.

Embarking on such endeavours is bound to encounter difficulties, requiring an inclusive bargaining process that would likely result in prolonged negotiations. But such an approach could pave the way towards enhancing existing financial instruments and developing market-based mechanisms among the regions and states in Malaysia. For instance, states could be compensated for their efforts along with acting as the basis to strengthen the implementation of existing fiscal initiatives, such as EFTs or a potential “debt-for-nature” swap programme. Regions and states that receive greater EFTs based on a larger share of forest cover are typically located in more remote areas, where there is greater fiscal needs and lower fiscal capacity. Meanwhile, regions that receive a lesser share of EFTs are often urban, relatively developed and could generate revenues through land and property-based revenue, such as taxes and permits from commercial activities. Another method includes allowing highly urbanised states with little forest areas, are carbon positive and have not achieved their fair-share target to purchase credits in less-developed states.

4.2 Developing market enablers for conservation

4.2.1 Deploy ‘first-best’ economic instruments for environmental and

climate action

The efficacy of economic instruments depends on the extent of their market or price effects that could impact on business, consumer and investor behaviours. The ideal instruments are known as “first-best” economic instruments, which compel businesses to internalise any negative externality resulting from their activities and decisions. “Hard” economic instruments, such as fiscal instruments in the form of taxes (e.g. carbon taxes), charge systems and market creation, are recognised internationally as first-best policy options28. A well-designed carbon pricing with suitably ambitious prices could increase the costs associated with the use of high-carbon technologies, which shifts market dynamics in a way that encourages the adoption of low-carbon technologies and the purchase of carbon credits, particularly for hard-to-abate sectors. As such, this will generate greater demand and supply for high-quality carbon projects within the country.

Similarly, incentivising the purchase of biodiversity credits might require regulations, such as mandatory biodiversity offsets in development projects, to compensate for unavoidable impacts beyond the effectiveness of mitigation measures. In the case of payments for ecosystem services, there is a need to review current water pricing mechanisms, including low tariffs, and increase the demand and efficacy for PES schemes. The design and implementation of these instruments requires careful consideration involving comprehensive stakeholder engagement to ensure political and social viability. In a nutshell, encouraging businesses to partake in conservation financing requires incentives and disincentives mechanisms, particularly through the implementation of hard economic instruments, such as pollution tax or resource pricing.

A whole-of-system approach rather than piecemeal responses must also be employed when designing these instruments. For example, in the case of carbon pricing, the instrument must be designed to account for the need to rationalise fossil fuel subsidies. Other schemes that encourage, enable and subsidise destructive business activities should be reviewed, especially those that encourage deforestation. For example, “program pembangunan ladang hutan” may need to be reviewed to prohibit or limit the development of monoculture plantations away from environmentally sensitive areas. Similarly, systemic issues, such as land grabbing, rent-seeking and corruption, pose a barrier to conservation financing and the attraction of investors.

4.2.2 Promote blended financing models to de-risk conservation projects

In response to the rising demand for ESG-oriented investments and portfolios in Malaysia, it is imperative to acknowledge the pivotal role played by the private sector, philanthropists as well as both development and commercial banks in mobilising finances. The need for this is imperative in the absence of clearly defined government policies. For example, CIMB Islamic Bank and Yayasan Hasanah are collaborating with Forever Sabah in the Babagon water-catchment area on PES schemes, while the United Nations Development Programme (UNDP) is actively engaging private banks on the issuance of the first Malaysian “tiger bond” to finance tiger conservation.

A wider promotion of blended finance would synergise public and private capital to mobilise financing for conservation projects that are often marginally bankable. Such an approach is not new but requires a systematic and coordinated approach to scale, especially in emerging markets, such as Malaysia. For starters, this approach could be first targeted at conservation projects that are attractive to the private sector or, in other words, is shovel ready. To reduce risks and improve bankability, more catalytic and concessional funding is required from the public sector, domestic and multilateral development banks, as well as philanthropic sources to help crowd-in private sector funding. Such funding can come in the form of grants or risk-sharing arrangements.

4.3 Build business ecosystem for conservation markets

4.3.1 Develop a national policy and regulatory framework for carbon trading

Malaysia needs robust oversight with clear and harmonised federal and state regulations to develop its carbon market responsibly and position itself as a producer of high-integrity carbon credits. Significant progress has been made with the ongoing development of a national carbon policy and dedicated legislation on climate change. These initiatives provide the basic framework to foster responsible carbon trading and the production of nature-based carbon credits.

The policy provides the opportunity to address the jurisdictional complexities surrounding carbon by clearly delineating the role of federal and state governments in regard to carbon-related responsibilities, as well as harmonising the legality surrounding carbon as a commodity and pollutant. Besides the broader questions surrounding carbon trading and sovereignty, the policy should also address various points that have been discussed previously, such as the establishment of state-level targets for forest (and consequently carbon) protection, a fair-share model, the roles and regulations of the VCM – including the establishment of a national registry, standards, ensuring free-prior informed consent and benefit sharing – and the requirement of additionality and ensuring permanence.

It is foreseeable that the federal government, through the Ministry of Natural Resources and Environmental Sustainability, will still be the focal point for emission-related matters and reporting to the UNFCCC. As carbon is ultimately within state jurisdiction, it is expected that states will formulate their own policies, legislation and procedures related to forest carbon trading, emulating Sarawak’s steps as currently being done by Sabah and Pahang. As states might respond differently, the national carbon market policy should provide the aspects and principles to be considered under the state carbon policy and legislation, in which the climate change bill can then provide the legal tooth to assist in the implementation of the policy.

Given the multitude of interests and stakes at play, it is imperative that policies and legislations concerning carbon trading, at the federal and state levels, undergo a rigorous, inclusive, and transparent stakeholder engagement process to ensure consensus. The federal government has taken steps in this direction with a three-month roadshow on the climate change bill, incorporating outcomes from discussion sessions with state governments and local authorities. But consultation efforts should also extend to encompass representatives from local and indigenous communities, employing a gender- responsive approach that upholds human rights. Additionally, the promulgation process of the climate change bill should allow for additional briefing sessions with Members of Parliament, affording ample time for review, particularly considering the technical complexities inherent within the subject matter.

4.3.2 Build the domestic expertise to develop and manage carbon projects

Developing conservation projects, including forest carbon projects, is a long and intricate process demanding considerable resources and manpower – from feasibility assessments, carbon baseline and emissions measurement, validation, stakeholder engagement and project execution. Malaysia is currently lacking domestic expertise in this regard, including capabilities to conduct assessments, monitoring, reporting, and verification (MRV) that is highly material to carbon credit buyers to ensure that the credits provide measurable benefits and minimise reputational risks. Institutional and human capacity at the government sector – both federal and state level – must also be strengthened to oversee, monitor and regulate carbon-trading activities. Technical assistance from international organisations and experienced firms should be encouraged while also implementing capacity building initiatives, such as training programmes, workshops and knowledge-exchange platforms.

4.3.3 Review existing laws and procedures to facilitate conservation projects

There is a need to review existing land code and state land enactments to allow third parties the “rights to manage”, such as allowing concessions to undertake conservation projects on land outside of protected areas and permanent reserved forests. Presently, land titles for alienated lands in Malaysia are limited to development activities, such as industry, building, and agriculture, and lack specific provisions for conservation or community-based projects. Similarly, state land regulations predominantly permit extractive activities, such as mining, agriculture and commercial through grant leases or temporary occupation licences. The proposed review could introduce new land use categories, establish appropriate rates and premiums, and define conditions and legal frameworks conducive to the establishment of sustainable, long-term conservation projects by interested parties.

4.4 Review existing laws and procedures to facilitate conservation projects

Nature-based solutions (NbS) implemented through strategic conservation projects hold the promise of addressing various societal challenges. These include climate change, biodiversity loss, food and water security, as well as the promotion of urban sustainability. However, it is imperative to tailor NbS to the Malaysian context to avoid the pitfalls of greenwashing, while upholding human rights and establishing clear guidelines for implementation.

To achieve this, a comprehensive strategy for NbS in Malaysia must be devised, emphasising the need to define and scale up NbS according to the country’s circumstances and requirements. The strategy should encompass, but not be restricted to, the following aspects.

First, NbS projects, such as carbon offsets, require an established definition, robust criteria and standards to prevent potential misuse or greenwashing, while maximising their potential to deliver co-benefits across various areas. This includes climate mitigation, adaptation, biodiversity conservation, social safeguards and other societal challenges related to the sustainable development goals.

This should be followed by strategic and targeted approaches when implementing NbS projects through prioritisation of project developments, particularly in critical ecological linkages to reconnect garmented forest landscapes of Central Forest Spine or Heart of Borneo, as well as water-stressed areas, to increase climate resilience.

While not all NbS projects guarantee income generation, the transition to NPE provides options for rural areas to generate high-value green jobs and foster social mobility. The notion that NPE would not hinder development in rural areas but serve as an engine of growth should be actively pushed forward. Promoting other forms of financial assistance to alleviate poverty, such as universal basic income or targeted cash transfers, should also be considered as part of a more holistic strategy.

To align such strategies, there needs to be an effective communication plan on NbS to reduce the risk of misinformation and inform government officials, especially at the state level, to act on accurate information, especially regarding carbon projects.

5. Conclusion

In conclusion, Malaysia faces significant challenges with deforestation, jeopardising its global reputation, resource security, and market access. These issues are deeply rooted in an inadequate incentive structure that fails to protect public goods, particularly ecosystem services, because of heavy reliance on land-based revenue by state governments.

The concept of an NPE presents a promising solution, which aims to create a market for conservation that directs capital towards conservation efforts through innovative financing mechanisms, in particular carbon trading. Malaysia is well positioned to lead in this area in providing high-quality and high-integrity nature-based projects but must first address systemic barriers, such as policy inconsistencies, jurisdictional complexities regarding carbon, policy and regulatory frameworks on carbon trading, as well as the lack of a robust domestic market and business-friendly environment.

Policies should focus on developing a fair-share contribution model at the state level, creating market enablers, building business ecosystems and contextualising nature-based solutions for Malaysia. To garner political support and maximise impact, conservation initiatives must be framed as offering direct benefits to local communities, such as job creation, social mobility and social cohesion while addressing broader climate and biodiversity objectives.

Endnotes

- Camoens, A., 2023. Record low levels of primary forest loss soon, says Nik Nazmi.The Star

- Rimbawatch. (2023). State of the Malaysian Rainforest 2023.

- Ministry of Natural Resources, Environment and Climate Change. (2022). Malaysia Fourth Biennial Update Report under the United Nations Framework Convention On Climate Change.

- Official Journal of the European Union. (2023). Regulation (EU) 2023/1115 of the European Parliament and of the Council of 31 May 2023 on the making available on the Union market and the export from the Union of certain commodities and products associated with deforestation and forest degradation and repealing Regulation (EU) No 995/2010.

- Radwin, M. (2021). FOREST Act bill would hold global suppliers accountable for illegal deforestation. Mongabay.

- UK Department for Environment Food & Rural Affairs. (2022). Consultation on implementing due diligence on forest risk commodities: Summary of responses and government response.

- Kementerian Tenaga dan Sumber Asli. (2021). Laporan Kajian Bencana Geologi Banjir Puing 2022 di Sungai Kupang, Kedah

- Jabatan Audit Negara. (2022). Laporan Tahunan 2022.

- National Policy on Biological Diversity 2016-2025 (Action 17.3), National Policy on Forestry (Strategy 3).

- The World Bank. (2023). State and trends of carbon pricing 2023.

- Shell & BCG. (2022). The voluntary carbon market: 2022 insights and trends.

- Yun, T. Z. (2023). Carbon Markets: Exciting year ahead for the VCM. The Edge

- The Asia Foundation. (2023). Carbon pricing and the business case for emissions reductions and nature conservation in Malaysia.

- Meyers, D., Bohorquez, J., Cumming, T., Emerton, L., Heuvel, O.v.d., Riva, M., and Victurine, R. (2020). Conservation finance: A framework. Conservation Finance Alliance.

- One of the functions classified in Permanent Reserved Forest in Peninsular Malaysia under the National Forestry Act 1984, where activities such as sustainable logging and plantations are allowed to be carried out under a licence issued out by the state government.

- Thevibes, 2023, Kelantan move to reclassify environmentally sensitive forests alarms Putrajaya.

- Teks Ucapan Perdana Menteri Kajian Separuh Penggal Rancangan Malaysia Ke-12 (KSP RMK12) 2021-2025.

- Ministry of Finance, 2023, Budget 2023 Speech.

- Live Carbon Prices

- Keynote Speech by YB Nik Nazmi Bin Nik Ahmad, Minister of Natural Resources, Environment and Climate Change. Nik Malaysia Carbon Market Forum 2023: Empowering Climate Actions through Carbon Markets.

- White, N., 2023, Bogus Carbon Credits are a ‘Pervasive’ Problem, Scientists Warn. TIME.

- State of Sarawak, 2022, The Sarawak Government Gazette, Part II, The Forests Ordinance, 2015 Forests (Forest Carbon Activity) Rules.

- Chang, J. (2023). Kuamut Rainforest Conservation Project [Paper presentation]. BCX Carbon Market Forum 2023: KLCC, Kuala Lumpur, Malaysia.

- NSW. (2023). Biodiversity Offsets Scheme.

- Ministry of Energy and Natural Resource. (2019). Malaysia’s Sixth National Report to the Convention on Biological Diversity.

- Global Environment Facility. (2021). GEF INVESTMENTS ON Payment for Ecosystem Services Schemes.

- The Star. (2024). Malaysia’s water tariff among lowest in Asean, says SPAN.

- De Mooij, R., Keen, M., & Parry, I. (2012). Fiscal Policy to Mitigate Climate Change.