Dhana Raj Markandu was quoted in The Malaysian Reserve, 20 August 2024

These capital-intensive efforts may necessitate govt subsidies, incentives or public-private partnerships to be realised

By Aufa Mardhiah

MALAYSIA’S goal of reaching net zero emissions by 2050 will be financially tough, needing a balance between environmental and economic needs.

The transition to a low-carbon economy is expected to involve substantial investments, particularly in renewable energy (RE) infrastructure, energy efficiency improvements and cleaner technologies.

These capital-intensive efforts may necessitate government subsidies, incentives or public-private partnerships to be realised.

Asia School of Business’ Centre for Technology, Strategy and Sustainability senior research associate Ganesha Pillai said Malaysia’s move towards net zero is likely to have major economic effects on various sectors, including businesses, jobs and overall economic growth.

For businesses, particularly in the energy, transportation and manufacturing sectors, transitioning to net zero will require substantial capital investment.

These costs will primarily stem from the need to invest in RE installations, develop energy efficiency measures and upgrade to low-carbon technologies.

Additionally, businesses will face compliance costs associated with new regulations and carbon pricing mechanisms, which could further strain their financial resources.

In terms of employment, the shift towards a net zero economy is likely to result in a transition from traditional industries to emerging green industries and services.

While this transition may lead to job losses in certain sectors, it will also create new job opportunities in others.

To support this shift, significant efforts in reskilling and upskilling the workforce will be essential to meet the demands of these new roles.

Regarding overall economic growth, Pillai said Malaysia may experience a slowdown in the short term due to the costs of transition and potential disruptions in traditional industries.

According to the National Energy Policy 2022, the energy sector, which currently contributes 28% of the country’s GDP and accounts for 25% of the total workforce, could face particular challenges.

However, in the long term, the transition to a net zero economy has the potential to stimulate innovation, attract foreign investments, and ultimately boost economic growth.

“As a developing country, Malaysia’s sources of economic growth will increasingly rely on investment and innovation in green technology and research and development (R&D) in green energy.

“While job losses in traditional industries may appear concerning, they could be outweighed by the growth in green industries,” Pillai told The Malaysian Reserve (TMR).

Balancing Cost and Benefits in Policy-making

Pillai said aggressive climate policies might cause short-term economic disruptions, including higher business costs and reduced competitiveness for carbon-intensive industries.

He added that Malaysia faces the challenge of balancing its need for economic growth with the imperative to reduce emissions, all while managing the risks of carbon leakage.

Hence, these aggressive policies could increase the cost of doing business and potentially restrict the development of certain industries, which might be perceived as a hindrance to growth.

To encourage businesses to reduce emissions, Malaysia can introduce carbon pricing mechanisms, such as a carbon tax or cap-and-trade systems.

Pillai also said Malaysia may need to offer subsidies or tax incentives to encourage investment in green technologies and RE, helping to lower capital costs.

This “carrots-and-sticks” approach supports the transition but may require a reallocation of resources.

Moreover, international taxation systems like the Carbon Border Adjustment Mechanism (CBAM) can serve as a further incentive for industries to transition and comply with environmental standards.

Apart from that, he said regulatory reforms are also essential in aligning economic growth with climate goals.

These could include revising energy tariffs, phasing out fossil fuel subsidies, and strengthening environmental regulations.

However, these reforms must be implemented gradually to minimise economic disruptions, especially given Malaysia’s current reliance on traditional fossil fuels.

International Support, Collaboration

International financial aid can help Malaysia cov(MyNAP) funded by the Green Climate Fund (GCF) can play critical roles in this process but Malaysia’s status as an upper-middle-income nation may limit its access to such funds, as poorer countries may be prioritised for financial aid.

As technology transfer is crucial for Malaysia’s transition, international cooperation can help Malaysia adopt and use the latest solutions in RE and energy efficiency.

Cooperative agreements, whether between two countries or more, can provide extra support by sharing knowledge, conducting joint research, and exchanging best practices. Moreover, they can bolster Malaysia’s negotiating position in global climate forums, ensuring that the country’s interests are adequately represented through principles like common but differentiated responsibilities and initiatives promoting a just transition.

Private Sector Involvement

To attract private companies’ participation in green technologies, Pillai suggested several steps or initiatives to make sustainable investments more attractive and financially viable.

One key approach is the provision of tax incentives, where companies investing in RE, energy efficiency, and low-carbon technologies can benefit from tax breaks, credits or deductions.

Additionally, the government could facilitate access to green financing through mechanisms such as green bonds, grants, and low-interest loans, which are specifically designed to support companies undertaking sustainable projects.

Another significant measure is encouraging public-private partnerships, which help drive investment in sustainable infrastructure by reducing financial risks and enhancing the benefits for both the public and private sectors.

Even so, investing in green technologies can have significant financial implications for businesses.

In the short term, Pillai said companies may encounter increased capital expenditures as they invest in new technologies, infrastructure and workforce training.

However, investments in energy efficiency and RE can reduce operational costs, enhance resilience to energy price fluctuations and improve competitiveness.

On the other hand, companies investing early in green technologies may gain a competitive edge in emerging markets, attracting environmentally conscious consumers and investors.

Financial Responsibility, Implementation

Pillai said to cover the costs of Malaysia’s net zero transition, the government may need to spend a lot on infrastructure upgrades, R&D, and offer subsidies and incentives for green projects.

Additionally, public investments may be required to support communities and workers affected by the transition.

“The responsibility of creating a suitable environment for sustainable financing falls on the policymakers.

“Of course, financial institutions would be keen on offering financial solutions towards a government-linked or government-endorsed project,” he said.

On top of that, the private sector will be expected to contribute significantly through investments in technology, innovation, and green infrastructure.

Private companies will play a critical role in scaling up RE projects and enhancing energy efficiency across various industries.

“Globally, the private sector’s financial contributions, driven by supportive policies, have been pivotal in accelerating the transition to a sustainable economy,” he added.

Pillai further noted that a balanced approach where both the public and private sectors share the financial burden can lead to more effective implementation of net zero strategies. This ensures that risks are distributed evenly.

Collaborative public-private investments can also lead to greater cost efficiency, with the public sector funding large-scale infrastructure projects and the private sector bringing expertise in technology deployment and innovation.

“The speed of Malaysia’s transition to net zero will likely depend on how well these financial responsibilities are divided. If either sector fails to meet its financial commitments, it could delay the implementation of net zero strategies,” he said.

Conversely, strong collaboration and financial commitment from both the public and private sectors could accelerate the transition, ensuring a smoother and timelier path to achieving net zero emissions.

Emissions Trajectory Versus Sustainable Future

As Malaysia considers the financial implications of transitioning to net zero emissions, the country faces a critical choice between continuing its current emissions trajectory and embracing a more sustainable future.

With experience in climate change and sustainability policy development, Malaysian Green Technology and Climate Change Centre consultant technical advisor Dr Gary Theseira said continuing on the current path exposes the economy to significant risks.

“Products and services with high carbon footprints may face rejection in both domestic and international markets due to their negative impact on customers’ scope 3 emissions.

“This could result in penalties such as carbon taxes, border adjustments, and other levies, ultimately reducing Malaysia’s attractiveness as an investment destination,” he told TMR.

On the other hand, transitioning to net zero offers clearer and potentially more manageable costs — drawing from the experiences of other countries that have already implemented relevant policies and regulations, such as Singapore.

Singapore’s fiscal and non-tax incentives for corporations, such as tax deductions for green R&D and green finance incentives, provide a model that Malaysia could follow.

Additionally, Singapore plans to issue up to S$35 billion (RM117 billion) in green bonds by 2030, highlighting the potential for government-backed financial instruments to support the transition.

Theseira said the risks of not transitioning are compounded by the increasing likelihood of extreme weather events, which necessitate investments in mitigation and adaptation strategies to protect the economy.

Moreover, non-compliance with international environmental standards, as seen in the challenges faced by Malaysia’s palm oil and rubber glove industries, could further jeopardise market access.

Despite these challenges, he believes that the transition to net zero presents significant financial benefits.

A comprehensive restructuring of resource management strategies across sectors such as energy, water, food and mobility can enhance efficiency, improve gross national income, reduce the wage gap and bolster Malaysia’s competitiveness in providing low-emission products and services.

To balance the costs and benefits, he said Malaysia must align its policies with its net zero targets, ensuring that emissions peaking, stabilisation and reduction are integrated into economic planning.

Apart from that, he highlighted that collaborative efforts between corporations and financiers are essential, with a focus on long-term financing to support the gestation periods of renewable energy projects and nature-based solutions.

In terms of specific policies and frameworks, Theseira said Malaysia already has a solid foundation laid out by the central bank and the Securities Commission Malaysia.

These institutions have issued policies that set the stage for multinational corporations, public listed companies, and other large corporations to engage in sustainable practices.

Additionally, the Simplified ESG Disclosure Guide tool, which is being utilised by SMEs, is instrumental in reducing the cost of transitioning to a more transparent economy.

These frameworks not only enhance investment opportunities but also accelerate the growth of the green economy, supporting Malaysia’s broader net zero ambitions.

Looking globally, he said Malaysia can draw lessons from countries like Singapore, South Korea and Japan, which have successfully managed similar financial challenges through innovative policies, diversified energy sources and strategic investments in green technologies.

Systematic Changes Required

Institute of Strategic and International Studies senior analyst Dhana Raj Markandu said the financial burden of transitioning Malaysia’s energy sector from fossil fuels to renewable sources is critical, as the majority of emissions come from the energy sector.

He believes that the transition is not a simple matter of replacing coal power plants as it involves a comprehensive change that requires new infrastructure and facilities.

The challenge lies not just in removing consistent and reliable energy sources, but in managing the complexities that come with integrating less predictable renewable sources.

As a result, he said the system needs to be more complex, with new infrastructure added to support these changes.

“The biggest hurdle is not the technology itself, but the financing required to implement these solutions. Finding the necessary funding is one challenge, but ensuring that it is allocated to solutions that will have the most impact is another,” he told TMR.

Currently, while there is significant investment in RE, there is also a pressing need to upgrade the grid system to support and accommodate these renewable sources effectively.

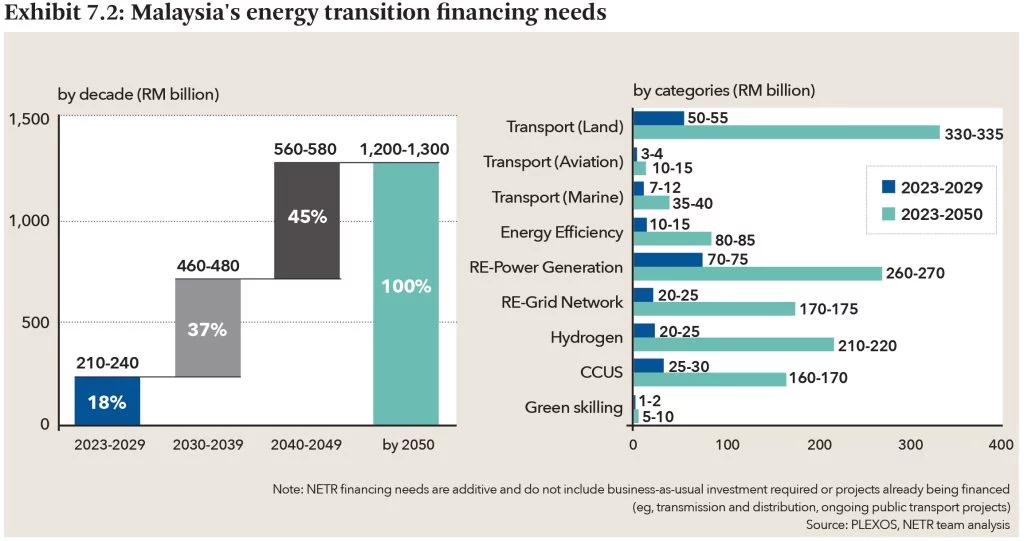

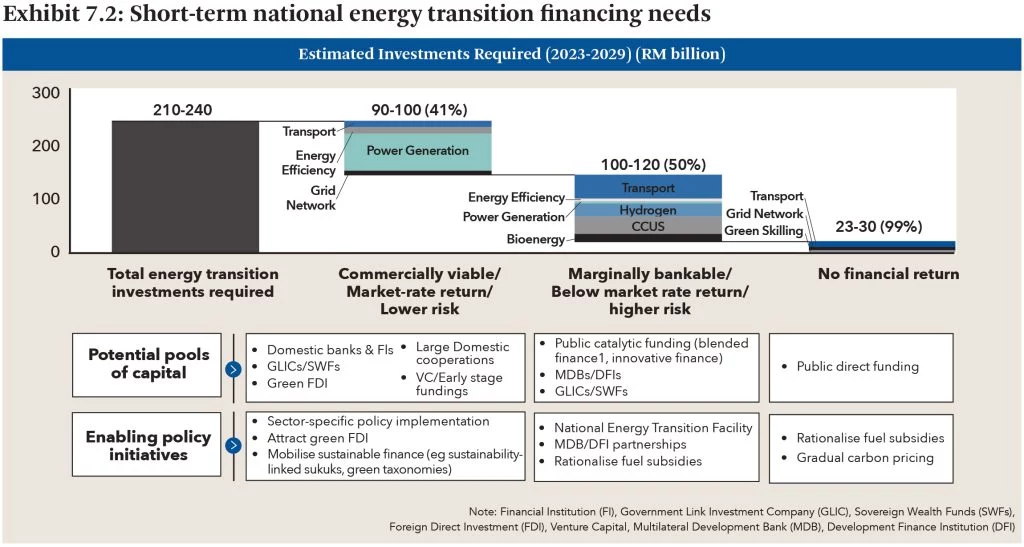

According to the National Energy Transition Roadmap, Malaysia’s energy transition goals are projected to require significant investments ranging between RM1.2 trillion to RM1.3 trillion by 2050.

Approximately 18% of this investment will be needed within the current decade, with funding sources categorised based on the risk profiles of the respective projects.

Dhana further highlighted that for commercially viable projects with market-rate returns or lower risk profiles, funding is expected to come from domestic banks and financial institutions, government-linked investment companies (GLICs), sovereign wealth funds (SWFs), foreign direct investments, large domestic corporations and venture capital.

Meanwhile, initiatives that are marginally bankable, offer below-market returns, or have higher risk profiles are anticipated to attract capital from public catalytic funding, blended finance, multilateral development banks, development finance institutions, GLICs and SWFs.

On the other hand, projects with no direct financial return, but essential for achieving the energy transition, will rely on public funding sources.

To support these efforts, he highlighted the Budget 2024 seed fund of RM2 billion for the National Energy Transition Facility, with an additional RM200 billion expected from financial institutions to drive these crucial initiatives.

Whether the transition to net zero will influence the people’s cost of living, he believes it is likely so, particularly in terms of energy prices, transportation expenses and the availability of subsidies or support measures.

“Sooner or later, we have to get used to the cost of electricity that is more reflective of reality. Currently, we are cushioned by subsidies, hence, we feel that it is cheap.

“But once we start to rationalise subsidies so that they are more targeted, then we will get to a point where the overall cost of living is higher,” he said.

However, Dhana said it is crucial that the changes are implemented in a way that protects the most vulnerable groups, ensuring they continue to receive necessary support.

In summary, Malaysia’s path to net zero by 2050 presents challenges but offers potential for a sustainable future through innovative finance, strategic investments and effective policies.

This article first published in The Malaysian Reserve, 20 August 2024